In the past few years, China has seen a significant decline in its billionaire population, with 36% of its wealthiest individuals falling off the rich list. This drastic drop, highlighted by recent findings from the Hurun Research Institute, is attributed to a complex combination of economic challenges, regulatory crackdowns, and a shifting business landscape.

These factors reflect both the current state of China’s economy and the broader impact of policy changes aimed at promoting “common prosperity.” As the country navigates through its housing crisis, high debt levels, and evolving government policies, China’s billionaire population is faced with unprecedented challenges.

Economic Turbulence and the Exodus of Wealth

One of the primary factors behind the shrinking number of Chinese billionaires is the nation’s recent economic struggles. Since its peak in 2021, China’s billionaire count has dropped by 432, bringing the total down from 1,185 to 753.

The housing market crisis, high local government debt, and weak consumer demand have all weighed on the economy, impacting industries that once fueled the growth of Chinese billionaires, especially in real estate and manufacturing.

A tightening economic environment, combined with government policies designed to moderate wealth inequality, has driven many of China’s wealthiest individuals to reconsider their positions and investment strategies within the country.

Read : China’s Richest Man Zhang Yiming’s Wealth Is Less Than Half of Ambani

For many, these factors have not only led to declining fortunes but also motivated some of China’s super-rich to consider moving their wealth outside of China. Regulations restricting the transfer of assets have led some to seek creative, and sometimes illegal, ways to move their money abroad.

Read : Wealth Capitals: Exploring the Top 10 Countries with the Most Billionaires

Many ultra-wealthy individuals are increasingly wary of drawing government scrutiny or facing regulatory backlash, opting instead to keep a lower profile or relocate altogether. This trend aligns with reports of a significant outflow of high-net-worth individuals, with as many as 15,200 expected to leave China in 2024 alone.

New Faces and the Shift to Tech and Green Energy

While traditional industries like real estate have seen a downturn, technology, renewable energy, and e-commerce have emerged as strong contenders driving the wealth of China’s new billionaire class.

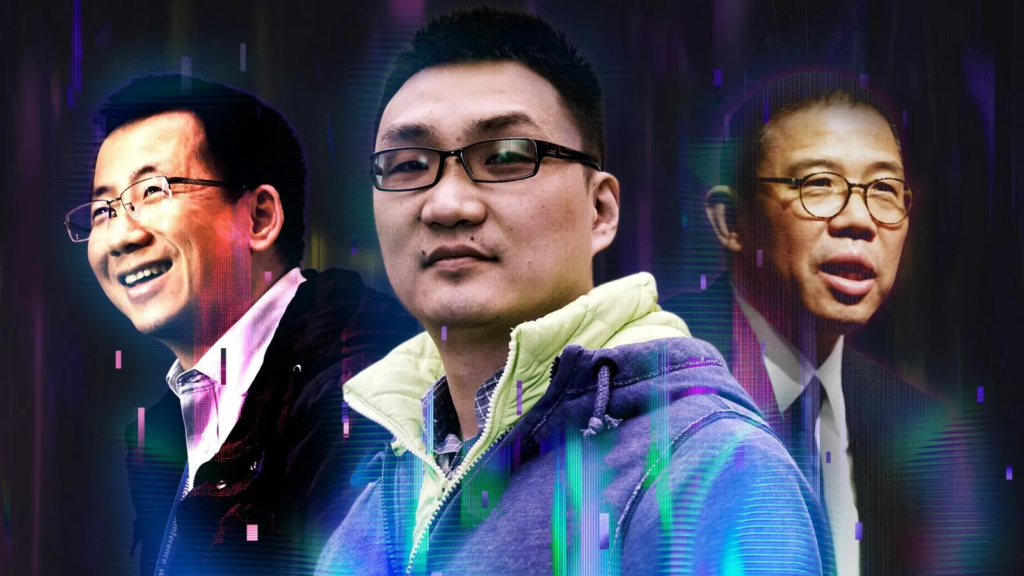

Zhang Yiming, the founder of ByteDance, which owns TikTok, now tops the Hurun list with a net worth of $49.3 billion, replacing Zhong Shanshan, a bottled water tycoon who once held the number one spot.

ByteDance’s global reach, with TikTok nearing 200 million users in the United States and its Chinese counterpart Douyin gaining popularity domestically, has helped Zhang’s fortune grow significantly.

In addition to tech, green energy and battery production are also becoming lucrative sectors, propelled by increased government support for industries that align with the country’s sustainable growth goals. Robin Zeng, founder of CATL, a leading lithium battery producer, exemplifies the new wave of Chinese billionaires making their mark through green technology.

Similarly, Li Zhenguo of solar panel manufacturer Longi represents the emerging renewable energy sector, which is reshaping the billionaire landscape in China. The trend signals a shift in government focus, encouraging wealth generation in high-tech and sustainable industries as part of a strategy to foster economic resilience and innovation.

This evolving profile of Chinese billionaires is partly a result of government policies that favor industries critical to long-term national goals, such as technology, clean energy, and manufacturing.

With increased support for green energy initiatives, the Chinese government is guiding capital into sectors that can drive both economic and environmental benefits, ensuring that the wealthiest individuals contribute to broader societal goals.

Crackdowns and the Push for “Common Prosperity”

Chinese President Xi Jinping’s push for “common prosperity” has led to regulatory changes that have impacted billionaires in specific sectors. The government’s calls for wealth redistribution have resulted in tighter regulations, especially on tech and real estate companies, where wealth and influence have traditionally concentrated.

Many tech giants, including Alibaba and Tencent, have come under government scrutiny, with some leaders, like Alibaba founder Jack Ma, facing severe repercussions following statements perceived as critical of government policies.

Ma, once a high-profile figure in Chinese tech, was forced to step back from public life after a series of regulatory measures impacted his company’s financial standing, suspending Ant Group’s highly anticipated IPO.

Such crackdowns have been a warning to other billionaires, prompting them to avoid the public eye and adopt a more compliant stance toward government policies.

The focus on equitable wealth distribution has led some of the ultra-wealthy to seek less visible methods of preserving their fortunes, with some even choosing to relocate their wealth and businesses outside China. As regulatory pressure builds, some wealthy individuals have opted to stay out of the public eye, avoiding any actions that could attract government scrutiny.

In response to these pressures, some wealthy Chinese citizens are reportedly finding unconventional means to move their money abroad, despite government-imposed limits. The restriction on capital outflow to $50,000 annually has led some to employ underground banking systems or invest in cryptocurrencies to move assets outside of China.

These measures indicate that the push for “common prosperity” has not only discouraged high-profile displays of wealth but has also prompted creative and sometimes risky ways for the superrich to secure their assets.