Nvidia’s rise in the tech world has been nothing short of remarkable, and its contributions to artificial intelligence (AI) and accelerated computing have redefined the industry.

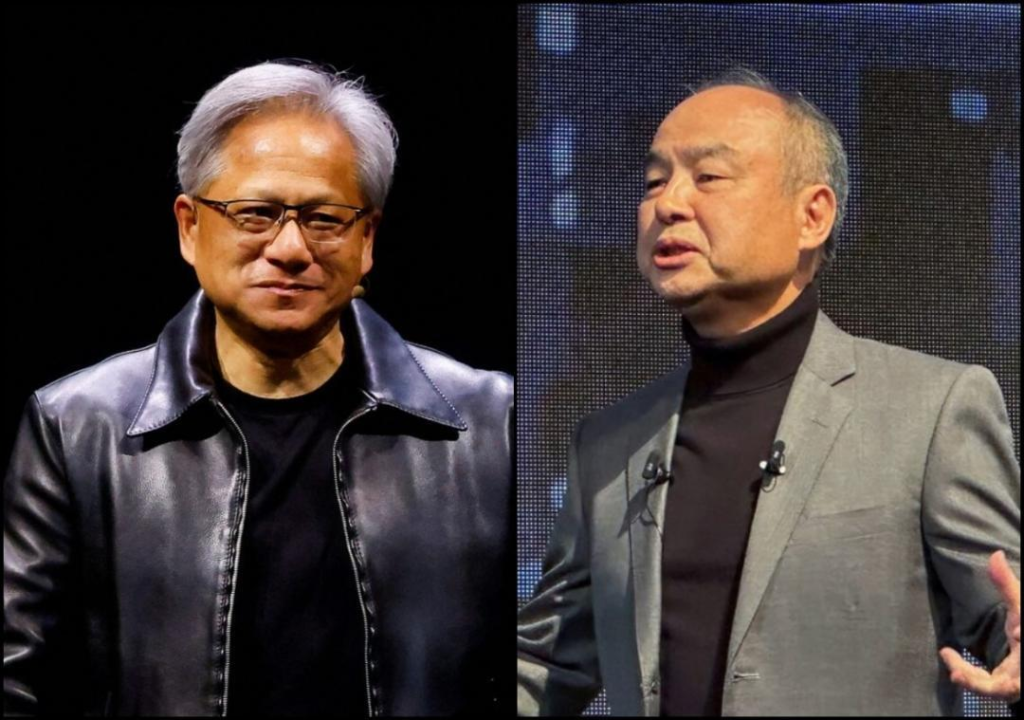

However, Nvidia CEO Jensen Huang recently shared a pivotal “what-if” moment in a conversation with SoftBank’s founder and CEO Masayoshi Son, where he expressed regret over not accepting Son’s offer to help acquire Nvidia nearly a decade ago.

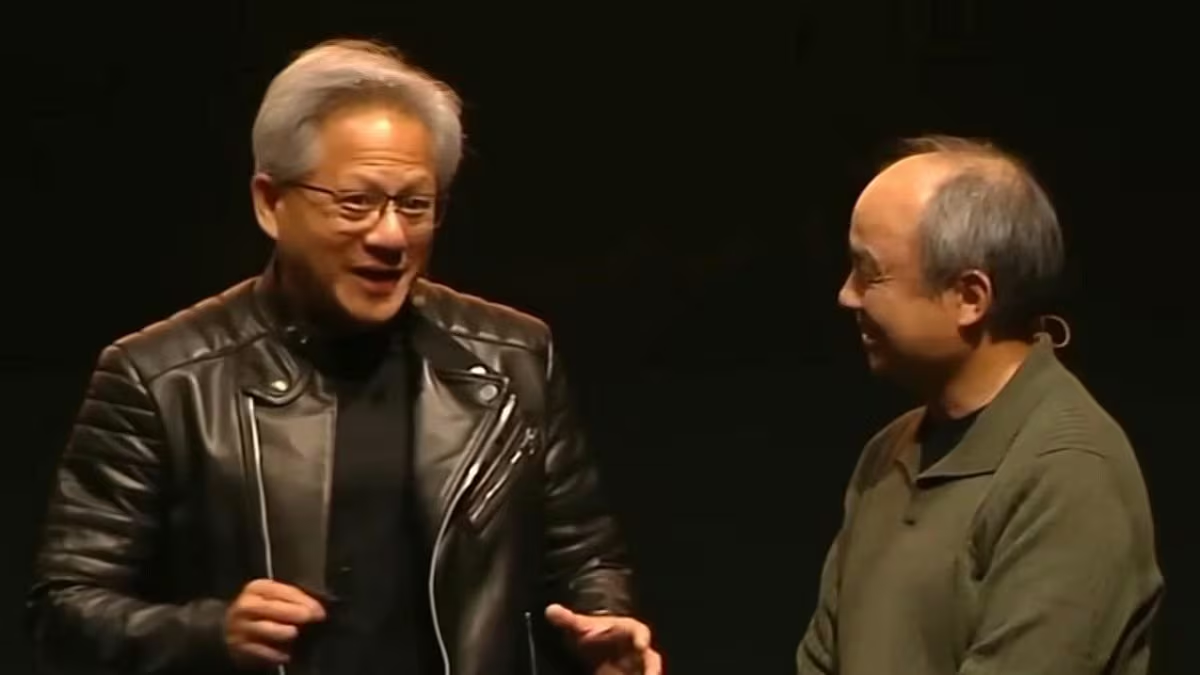

This reflection came during the Nvidia AI Summit in Japan, marking a noteworthy insight into the two visionary leaders’ perspectives on Nvidia’s valuation and potential.

Turning Down an Offer of a Lifetime

Jensen Huang and Son’s relationship dates back to a time when SoftBank was Nvidia’s largest external shareholder, holding a 5 percent stake. At the Nvidia AI Summit, Son recalled how he believed the market was undervaluing Nvidia’s potential.

During a fireside chat at the summit, Son said, “Jensen, the market doesn’t understand the value of Nvidia. Your future is incredible, but the market doesn’t get it.” Recognizing Nvidia’s vision and unique place in technology, Son offered to lend Jensen Huang the capital needed to buy the company outright. At the time, this could have given Huang unprecedented control over Nvidia’s trajectory.

Read : Everything You Need to Know About the World’s Most Valuable Company: Nvidia

However, Huang declined Son’s offer—a choice he later admitted he regretted. He laughed and acknowledged that perhaps he had underestimated the opportunity and Son’s foresight.

Read : Reliance and Nvidia Unite for AI Infrastructure in India

Today, Nvidia’s valuation has soared, with its GPUs powering much of the world’s AI capabilities, including advancements in healthcare, automotive technology, and robotics. SoftBank, meanwhile, missed out on what could have been one of the most profitable holdings in its portfolio.

The Significance of SoftBank’s Exit from Nvidia

A few years after his offer to Huang, Son sold off SoftBank’s stake in Nvidia, a move influenced by pressures on SoftBank’s Vision Fund. Back then, Nvidia’s stock was not faring well, and Son opted to divest, selling a position that was later worth more than $160 billion.

Had SoftBank held onto the Nvidia stake, it would have rivaled or even exceeded its historic investment in Alibaba. In retrospect, Son’s early confidence in Nvidia proved prescient, especially as the company surged to prominence in AI and computing, paving the way for its integral role in the global technology landscape.

Though Son had divested from Nvidia, he continued to lead SoftBank in investment ventures across high-potential AI companies and tech-forward firms. This foresight reflects his strategic inclination toward identifying revolutionary technology.

Son’s Vision Funds have backed countless companies focused on AI, automation, and big data—sectors that align with his belief in AI’s transformative impact on every industry. Nvidia’s current standing has validated Son’s original perspective on the company’s potential, showing how strategic investments in AI can yield astronomical returns in the long run.

Forging a New Partnership for AI in Japan

Despite this missed opportunity, Huang and Son’s discussion culminated in an announcement of a landmark partnership aimed at AI infrastructure development in Japan.

Nvidia and SoftBank have agreed to collaborate to accelerate Japan’s technology landscape, focusing on transforming robotics, automotive industries, telecommunications, and healthcare through cutting-edge AI systems.

This partnership will create a robust AI-driven infrastructure that aligns with both Nvidia’s expertise in accelerated computing and SoftBank’s local influence and resources.

Joining forces with SoftBank Corp., the Japanese cloud leader, and other key tech firms—GMO Internet Group, Highreso, KDDI, Rutilea, and SAKURA Internet—the collaboration marks an ambitious effort to revolutionize Japan’s digital ecosystem.

Nvidia’s advanced GPUs and data center expertise combined with SoftBank’s market reach promises to transform sectors reliant on AI-powered innovations. Japan’s AI-driven infrastructure will not only benefit these industries but will also contribute to the global advancement of robotics, healthcare diagnostics, autonomous driving, and telecommunications.

As Nvidia and SoftBank embark on this journey, the initiative promises far-reaching implications for Japan’s economy and technological future, underscoring both Huang and Son’s vision for AI as a transformative force. This partnership could serve as a model for other nations, positioning Japan as a leader in AI integration across various sectors.

On this website, you will find details about the 1Win gambling platform in Nigeria.

It covers key features, including the well-known online game Aviator.

1win casino online

You can also discover betting options.

Enjoy a seamless gaming experience!

Этот сайт — известное цифровое медиа.

Мы быстро представляем ключевые репортажи.

https://rftimes.ru/html/smi.html

Коллектив журналистов стремится давать только проверенную информацию.

Оставайтесь с нами, чтобы всегда узнавать актуальные новости!

Макс Мара — культовый итальянский модный бренд, основанный в середине XX века предпринимателем Акилле Марамотти. Компания обрёл эталоном элегантности и качества.

Дизайнерский подход Max Mara основан на классических силуэтов и премиальных материалов, таких как шерсть и кашемир. Знаменитое пальто Teddy закрепило статус визитной карточкой бренда.

https://forum.home-visa.ru/viewtopic.php?f=69&t=1347992

Сегодня компания разрабатывает не только верхнюю одежду, но и аксессуары. Бренд остаётся символом стиля и роскоши, покоряя женщин по всему миру.

Philipp Plein — это экстравагантный бренд, основанный дизайнером Филиппом Плейном в 1998 году.

Он прославился смелым дизайном и роскошными элементами.

В коллекциях бренда можно увидеть символику черепов, декор из страз и металлические детали.

https://zapp.red/myforum/topic/%d0%ba%d0%b0%d0%ba-%d0%b2%d0%b0%d0%bc-%d0%b1%d1%80%d0%b5%d0%bd%d0%b4%d0%b5-%d0%be%d0%b4%d0%b5%d0%b6%d0%b4%d1%8b-philipp-plein/#postid-159822

Philipp Plein привлекает внимание звезд и ценителей дорогого стиля.

Одежда марки отражает дерзкий дух и уверенность.

Вещи бренда созданы для тех, кто любит стильные образы и не боится быть в центре внимания.

На данном сайте АвиаЛавка (AviaLavka) вы можете забронировать выгодные авиабилеты по всему миру.

Мы предлагаем лучшие тарифы от надежных авиакомпаний.

Удобный интерфейс поможет быстро подобрать подходящий рейс.

https://www.avialavka.ru

Гибкая система поиска помогает подобрать самые дешевые варианты перелетов.

Покупайте билеты в пару кликов без скрытых комиссий.

АвиаЛавка — ваш удобный помощник в поиске авиабилетов!

На этом сайте вы найдете клинику психологического здоровья, которая предоставляет психологические услуги для людей, страдающих от тревоги и других ментальных расстройств. Мы предлагаем индивидуальный подход для восстановления ментального здоровья. Наши опытные психологи готовы помочь вам решить проблемы и вернуться к сбалансированной жизни. Опыт наших психологов подтверждена множеством положительных рекомендаций. Запишитесь с нами уже сегодня, чтобы начать путь к восстановлению.

http://jarviswinery.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fk%2Fkorvalol%2F

reparación de maquinaria agrícola

Sistemas de ajuste: clave para el funcionamiento uniforme y efectivo de las máquinas.

En el mundo de la ciencia actual, donde la eficiencia y la confiabilidad del sistema son de suma relevancia, los aparatos de ajuste tienen un papel crucial. Estos equipos adaptados están creados para calibrar y estabilizar partes giratorias, ya sea en dispositivos manufacturera, transportes de movilidad o incluso en aparatos de uso diario.

Para los expertos en reparación de sistemas y los ingenieros, operar con aparatos de calibración es importante para garantizar el desempeño fluido y fiable de cualquier mecanismo giratorio. Gracias a estas herramientas tecnológicas avanzadas, es posible disminuir significativamente las sacudidas, el sonido y la carga sobre los soportes, extendiendo la longevidad de piezas valiosos.

Igualmente significativo es el función que cumplen los sistemas de balanceo en la atención al usuario. El ayuda profesional y el mantenimiento permanente aplicando estos equipos permiten brindar asistencias de alta estándar, mejorando la bienestar de los compradores.

Para los propietarios de empresas, la aporte en sistemas de balanceo y sensores puede ser fundamental para optimizar la rendimiento y rendimiento de sus dispositivos. Esto es principalmente importante para los inversores que manejan modestas y intermedias emprendimientos, donde cada aspecto importa.

También, los sistemas de balanceo tienen una gran implementación en el ámbito de la seguridad y el monitoreo de estándar. Habilitan encontrar posibles fallos, evitando mantenimientos costosas y problemas a los aparatos. Incluso, los indicadores extraídos de estos sistemas pueden aplicarse para perfeccionar procedimientos y aumentar la reconocimiento en plataformas de investigación.

Las campos de uso de los dispositivos de calibración cubren variadas ramas, desde la manufactura de bicicletas hasta el seguimiento ambiental. No importa si se refiere de extensas fabricaciones de fábrica o limitados establecimientos caseros, los sistemas de calibración son indispensables para asegurar un rendimiento eficiente y sin riesgo de paradas.

Прохождение сертификации в России является важным процессом легальной реализации товаров.

Этот процесс обеспечивает соответствие установленным требованиям техническим регламентам и правилам, что защищает потребителей от некачественных товаров.

сертификация качества

К тому же, сертификация помогает деловые отношения с заказчиками и повышает конкурентные преимущества для бизнеса.

Без сертификации, возможны юридические риски и сложности при ведении бизнеса.

Таким образом, оформление документации не просто формальностью, но и важным фактором для успешного развития компании в России.

Even with the popularity of digital timepieces, mechanical watches continue to be iconic.

A lot of enthusiasts value the intricate design that goes into mechanical watches.

Unlike modern wearables, which become outdated, mechanical watches remain prestigious through generations.

http://bilderschuppen.net/viewtopic.php?f=10&t=17455

High-end manufacturers are always introducing new mechanical models, confirming that their desirability is as high as ever.

To a lot of people, a mechanical watch is not just a way to tell time, but a reflection of craftsmanship.

Even as high-tech wearables offer convenience, traditional timepieces have soul that never goes out of style.

Почему BlackSprut привлекает внимание?

Платформа BlackSprut вызывает интерес разных сообществ. Почему о нем говорят?

Этот проект обеспечивает разнообразные опции для аудитории. Оформление системы отличается простотой, что позволяет ей быть понятной без сложного обучения.

Необходимо помнить, что BlackSprut работает по своим принципам, которые делают его особенным в определенной среде.

Обсуждая BlackSprut, нельзя не упомянуть, что определенная аудитория имеют разные мнения о нем. Одни выделяют его возможности, а некоторые относятся к нему неоднозначно.

В целом, эта платформа продолжает быть объектом интереса и вызывает заинтересованность разных пользователей.

Ищете рабочее зеркало БлэкСпрут?

Хотите узнать актуальное ссылку на BlackSprut? Мы поможем.

bs2best

Иногда платформа перемещается, поэтому приходится искать актуальное ссылку.

Мы мониторим за актуальными доменами чтобы предоставить новым линком.

Проверьте рабочую версию сайта прямо сейчас!

На нашей платформе доступны разнообразные онлайн-слоты.

Мы предлагаем подборку автоматов от топ-разработчиков.

Каждый слот обладает интересным геймплеем, дополнительными возможностями и честными шансами на выигрыш.

http://themixer.ru/go.php?url=https://casinoreg.net

Вы сможете запускать слоты бесплатно или играть на деньги.

Интерфейс просты и логичны, что облегчает поиск игр.

Для любителей онлайн-казино, данный ресурс стоит посетить.

Присоединяйтесь прямо сейчас — возможно, именно сегодня вам повезёт!

Navigating cancer information requires reliable sources and emotional support. Understanding different cancer types, stages, and treatment options is complex. Learning about screening guidelines and risk reduction strategies is empowering. Familiarity with medical preparations used in oncology, like chemotherapy or immunotherapy, is crucial. Knowing about side effect management improves quality of life during treatment. Finding trustworthy, compassionate information is paramount for patients and families. The iMedix podcast tackles difficult health topics like cancer with clarity. It’s a health care podcast providing valuable context and information. Follow my health podcast recommendation: iMedix offers cancer insights. Visit iMedix.com for comprehensive resources.

Eye health requires regular check-ups and awareness of common conditions. Understanding issues like cataracts, glaucoma, or macular degeneration is important. Learning about protective measures like wearing sunglasses benefits long-term vision. Familiarity with medical preparations like eye drops for various conditions is relevant. Knowing when to seek professional eye care is crucial. Access to reliable information promotes good vision habits. The iMedix podcast covers sensory health, including vision care. It serves as an online health information podcast for holistic well-being. Listen to the iMedix online health podcast for eye health tips. iMedix provides trusted health advice for preserving sight.

На этом сайте вы можете испытать большим выбором игровых автоматов.

Эти слоты славятся яркой графикой и увлекательным игровым процессом.

Каждый игровой автомат предоставляет уникальные бонусные раунды, повышающие вероятность победы.

1xbet казино

Слоты созданы для любителей азартных игр всех мастей.

Есть возможность воспользоваться демо-режимом, и потом испытать азарт игры на реальные ставки.

Проверьте свою удачу и получите удовольствие от яркого мира слотов.

На этом сайте вы можете испытать большим выбором игровых автоматов.

Игровые автоматы характеризуются яркой графикой и интерактивным игровым процессом.

Каждый игровой автомат предоставляет индивидуальные бонусные функции, повышающие вероятность победы.

1win games

Слоты созданы для как новичков, так и опытных игроков.

Есть возможность воспользоваться демо-режимом, а затем перейти к игре на реальные деньги.

Попробуйте свои силы и окунитесь в захватывающий мир слотов.

Наш веб-портал — официальная страница лицензированного детективного агентства.

Мы предлагаем помощь по частным расследованиям.

Коллектив детективов работает с повышенной дискретностью.

Мы занимаемся сбор информации и детальное изучение обстоятельств.

Нанять детектива

Любой запрос обрабатывается персонально.

Применяем новейшие технологии и работаем строго в рамках закона.

Нуждаетесь в реальную помощь — добро пожаловать.

Hello, i feel that i noticed you visited my web site thus i came to go back the desire .I’m attempting to in finding things to enhance my site!I guess its ok to make use of some of your ideas!!

Thanks for sharing superb informations. Your web site is so cool. I’m impressed by the details that you ve on this site. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for more articles. You, my friend, ROCK! I found simply the info I already searched everywhere and just could not come across. What a perfect web site.

One X Bet Promo Code – Vip Bonus as much as 130 Euros

Apply the One X Bet bonus code: 1XBRO200 while signing up in the App to avail exclusive rewards provided by One X Bet and get welcome bonus as much as 100%, for sports betting and a 1950 Euros with one hundred fifty free spins. Start the app and proceed with the registration process.

The 1XBet bonus code: Code 1XBRO200 gives an amazing sign-up bonus for first-time users — a complete hundred percent up to €130 once you register. Promotional codes serve as the key to obtaining rewards, also One X Bet’s bonus codes are no exception. After entering the code, bettors can take advantage from multiple deals at different stages within their betting activity. Although you aren’t entitled for the welcome bonus, 1XBet India makes sure its regular customers receive gifts through regular bonuses. Check the Promotions section via their platform often to keep informed about current deals designed for existing players.

https://tech.blakebusinessservices.com/how-to-select-the-best-world-wide-web-designers-2021-3806306591746755160

Which 1xBet promo code is currently active at this moment?

The promotional code applicable to 1xBet equals 1xbro200, enabling novice players signing up with the betting service to access a reward worth 130 dollars. To access exclusive bonuses pertaining to gaming and bet placement, kindly enter our bonus code related to 1XBET in the registration form. To make use of such a promotion, future players should enter the promo code Code 1xbet during the registration step so they can obtain double their deposit amount on their initial deposit.

В данном ресурсе вы можете найти свежие бонусы Melbet-промо.

Используйте их зарегистрировавшись на сайте чтобы получить до 100% за первое пополнение.

Плюс ко всему, здесь представлены бонусы для текущих акций для лояльных участников.

melbet промокод

Следите за обновлениями на странице бонусов, чтобы не упустить выгодные предложения в рамках сервиса.

Каждый бонус обновляется на работоспособность, и обеспечивает безопасность при использовании.

It’s best to take part in a contest for one of the best blogs on the web. I’ll recommend this web site!

One X Bet Bonus Code – Vip Bonus maximum of €130

Use the 1XBet promo code: 1XBRO200 while signing up on the app to avail special perks given by 1XBet to receive €130 up to a full hundred percent, for placing bets along with a $1950 including free spin package. Start the app followed by proceeding with the registration process.

The One X Bet bonus code: Code 1XBRO200 provides an amazing sign-up bonus for new users — 100% maximum of 130 Euros during sign-up. Promo codes act as the key to unlocking bonuses, plus 1XBet’s bonus codes are no exception. When applying such a code, players can take advantage of various offers at different stages within their betting activity. Although you’re not eligible for the initial offer, 1xBet India guarantees its devoted players receive gifts with frequent promotions. Check the Promotions section on the site frequently to stay updated about current deals tailored for existing players.

1xbet promo code nepal

What 1XBet promo code is presently available today?

The bonus code applicable to 1XBet stands as 1XBRO200, permitting new customers registering with the betting service to access a reward amounting to €130. To access unique offers related to games and bet placement, kindly enter this special code for 1XBET during the sign-up process. In order to benefit of this offer, potential customers need to type the promo code 1xbet at the time of registering process so they can obtain a 100% bonus for their first payment.

On this platform, you can access lots of slot machines from top providers.

Players can experience traditional machines as well as feature-packed games with high-quality visuals and interactive gameplay.

Even if you’re new or a casino enthusiast, there’s always a slot to match your mood.

play games

All slot machines are instantly accessible 24/7 and designed for laptops and tablets alike.

No download is required, so you can jump into the action right away.

Platform layout is intuitive, making it simple to browse the collection.

Join the fun, and dive into the thrill of casino games!

本站 提供 海量的 成人资源,满足 各类人群 的 兴趣。

无论您喜欢 哪一类 的 内容,这里都 应有尽有。

所有 内容 都经过 精心筛选,确保 高质量 的 视觉享受。

A片

我们支持 各种终端 访问,包括 手机,随时随地 自由浏览。

加入我们,探索 激情时刻 的 成人世界。

Equilibrado de piezas

El Balanceo de Componentes: Elemento Clave para un Desempeño Óptimo

¿Alguna vez has notado vibraciones extrañas en una máquina? ¿O tal vez ruidos que no deberían estar ahí? Muchas veces, el problema está en algo tan básico como un desequilibrio en alguna pieza rotativa . Y créeme, ignorarlo puede costarte más de lo que imaginas.

El equilibrado de piezas es un procedimiento clave en la producción y cuidado de equipos industriales como ejes, volantes, rotores y partes de motores eléctricos . Su objetivo es claro: impedir oscilaciones que, a la larga, puedan provocar desperfectos graves.

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene un neumático con peso desigual. Al acelerar, empiezan las sacudidas, el timón vibra y resulta incómodo circular así. En maquinaria industrial ocurre algo similar, pero con consecuencias considerablemente más serias:

Aumento del desgaste en soportes y baleros

Sobrecalentamiento de partes críticas

Riesgo de fallos mecánicos repentinos

Paradas imprevistas que exigen arreglos costosos

En resumen: si no se corrige a tiempo, una leve irregularidad puede transformarse en un problema grave .

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Perfecto para elementos que operan a velocidades altas, tales como ejes o rotores . Se realiza en máquinas especializadas que detectan el desequilibrio en varios niveles simultáneos. Es el método más preciso para garantizar un funcionamiento suave .

Equilibrado estático

Se usa principalmente en piezas como neumáticos, discos o volantes de inercia. Aquí solo se corrige el peso excesivo en un plano . Es rápido, sencillo y eficaz para ciertos tipos de maquinaria .

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se quita peso en el punto sobrecargado

Colocación de contrapesos: como en ruedas o anillos de volantes

Ajuste de masas: habitual en ejes de motor y partes relevantes

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones accesibles y muy efectivas, como :

✅ Balanset-1A — Tu compañero compacto para medir y ajustar vibraciones

El Balanceo de Componentes: Elemento Clave para un Desempeño Óptimo

¿ En algún momento te has dado cuenta de movimientos irregulares en una máquina? ¿O tal vez escuchaste ruidos anómalos? Muchas veces, el problema está en algo tan básico como un desequilibrio en alguna pieza rotativa . Y créeme, ignorarlo puede costarte bastante dinero .

El equilibrado de piezas es una tarea fundamental tanto en la fabricación como en el mantenimiento de maquinaria agrícola, ejes, volantes, rotores y componentes de motores eléctricos . Su objetivo es claro: impedir oscilaciones que, a la larga, puedan provocar desperfectos graves.

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene una rueda desequilibrada . Al acelerar, empiezan las vibraciones, el volante tiembla, e incluso puedes sentir incomodidad al conducir . En maquinaria industrial ocurre algo similar, pero con consecuencias considerablemente más serias:

Aumento del desgaste en cojinetes y rodamientos

Sobrecalentamiento de elementos sensibles

Riesgo de averías súbitas

Paradas imprevistas que exigen arreglos costosos

En resumen: si no se corrige a tiempo, una mínima falla podría derivar en una situación compleja.

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Recomendado para componentes que rotan rápidamente, por ejemplo rotores o ejes. Se realiza en máquinas especializadas que detectan el desequilibrio en dos o más planos . Es el método más fiable para lograr un desempeño estable.

Equilibrado estático

Se usa principalmente en piezas como ruedas, discos o volantes . Aquí solo se corrige el peso excesivo en una sola superficie . Es rápido, fácil y funcional para algunos equipos .

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se perfora la región con exceso de masa

Colocación de contrapesos: tal como en neumáticos o perfiles de poleas

Ajuste de masas: habitual en ejes de motor y partes relevantes

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones accesibles y muy efectivas, como :

✅ Balanset-1A — Tu aliado portátil para equilibrar y analizar vibraciones

Equilibrar rápidamente

Equilibrado dinámico portátil:

Respuesta inmediata sin mover equipos

Imagina esto: tu rotor inicia con movimientos anormales, y cada minuto de inactividad cuesta dinero. ¿Desmontar la máquina y esperar días por un taller? Descartado. Con un equipo de equilibrado portátil, corriges directamente en el lugar en horas, sin mover la maquinaria.

¿Por qué un equilibrador móvil es como un “kit de supervivencia” para máquinas rotativas?

Compacto, adaptable y potente, este dispositivo es el recurso básico en cualquier intervención. Con un poco de práctica, puedes:

✅ Corregir vibraciones antes de que dañen otros componentes.

✅ Minimizar tiempos muertos y mantener la operación.

✅ Trabajar en lugares remotos, desde plataformas petroleras hasta plantas eólicas.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Acceder al rotor (eje, ventilador, turbina, etc.).

– Instalar medidores sin obstáculos.

– Modificar la distribución de masa (agregar o quitar contrapesos).

Casos típicos donde conviene usarlo:

La máquina muestra movimientos irregulares o ruidos atípicos.

No hay tiempo para desmontajes (operación prioritaria).

El equipo es de alto valor o esencial en la línea de producción.

Trabajas en campo abierto o lugares sin talleres cercanos.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Rápida intervención (sin demoras) | ❌ Retrasos por programación y transporte |

| ✔ Monitoreo preventivo (evitas fallas mayores) | ❌ Suele usarse solo cuando hay emergencias |

| ✔ Reducción de costos operativos con uso continuo | ❌ Costos recurrentes por servicios |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: espacio para instalar sensores y realizar ajustes.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Software fácil de usar (con instrucciones visuales y automatizadas).

Evaluación continua (informes gráficos comprensibles).

Autonomía prolongada (ideales para trabajo en campo).

Ejemplo práctico:

Un molino en una mina comenzó a vibrar peligrosamente. Con un equipo portátil, el técnico identificó el problema en menos de media hora. Lo corrigió añadiendo contrapesos y evitó una parada de 3 días.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Formato claro ayuda a captar ideas clave.

– Enfoque práctico: Se añaden ejemplos reales y comparaciones concretas.

– Lenguaje persuasivo: Frases como “herramienta estratégica” o “previenes consecuencias críticas” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más instructivo) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

Servicio de Equilibrado

¿Oscilaciones inusuales en tu equipo industrial? Servicio de balanceo dinámico en campo y comercialización de dispositivos especializados.

¿Has detectado movimientos extraños, sonidos atípicos o desgaste acelerado en tus máquinas? Estos son señales claras de que tu equipo industrial necesita un equilibrado dinámico profesional.

Sin necesidad de desinstalar y transportar tus máquinas a un taller, nuestros técnicos se desplazan a tu fábrica con tecnología avanzada para solucionar la falla sin detener tus procesos.

Beneficios de nuestro servicio de equilibrado in situ

✔ Evitamos desarmados y transportes — Trabajamos directamente en tus instalaciones.

✔ Evaluación detallada — Empleamos dispositivos de alta precisión para detectar la causa.

✔ Resultados inmediatos — Corrección en pocas horas.

✔ Reporte completo — Documentamos los resultados antes y después del equilibrado.

✔ Experiencia multidisciplinar — Solucionamos problemas en maquinaria pesada y liviana.

El Equilibrado de Piezas: Clave para un Funcionamiento Eficiente

¿Alguna vez has notado vibraciones extrañas en una máquina? ¿O tal vez ruidos que no deberían estar ahí? Muchas veces, el problema está en algo tan básico como una irregularidad en un componente giratorio . Y créeme, ignorarlo puede costarte caro .

El equilibrado de piezas es un procedimiento clave en la producción y cuidado de equipos industriales como ejes, volantes, rotores y partes de motores eléctricos . Su objetivo es claro: impedir oscilaciones que, a la larga, puedan provocar desperfectos graves.

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene una llanta mal nivelada . Al acelerar, empiezan los temblores, el manubrio se mueve y hasta puede aparecer cierta molestia al manejar . En maquinaria industrial ocurre algo similar, pero con consecuencias aún peores :

Aumento del desgaste en soportes y baleros

Sobrecalentamiento de elementos sensibles

Riesgo de averías súbitas

Paradas no planificadas y costosas reparaciones

En resumen: si no se corrige a tiempo, una mínima falla podría derivar en una situación compleja.

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Ideal para piezas que giran a alta velocidad, como rotores o ejes . Se realiza en máquinas especializadas que detectan el desequilibrio en dos o más planos . Es el método más exacto para asegurar un movimiento uniforme .

Equilibrado estático

Se usa principalmente en piezas como ruedas, discos o volantes . Aquí solo se corrige el peso excesivo en una sola superficie . Es ágil, práctico y efectivo para determinados sistemas.

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se quita peso en el punto sobrecargado

Colocación de contrapesos: por ejemplo, en llantas o aros de volantes

Ajuste de masas: típico en bielas y elementos estratégicos

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones accesibles y muy efectivas, como :

✅ Balanset-1A — Tu aliado portátil para equilibrar y analizar vibraciones

Equilibrado dinámico portátil:

Soluciones rápidas sin desmontar máquinas

Imagina esto: tu rotor empieza a temblar, y cada minuto de inactividad cuesta dinero. ¿Desmontar la máquina y esperar días por un taller? Olvídalo. Con un equipo de equilibrado portátil, resuelves sobre el terreno en horas, sin mover la maquinaria.

¿Por qué un equilibrador móvil es como un “herramienta crítica” para máquinas rotativas?

Pequeño, versátil y eficaz, este dispositivo es la herramienta que todo técnico debería tener a mano. Con un poco de práctica, puedes:

✅ Prevenir averías mayores al detectar desbalances.

✅ Minimizar tiempos muertos y mantener la operación.

✅ Trabajar en lugares remotos, desde plataformas petroleras hasta plantas eólicas.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Tener acceso físico al elemento rotativo.

– Ubicar dispositivos de medición sin inconvenientes.

– Realizar ajustes de balance mediante cambios de carga.

Casos típicos donde conviene usarlo:

La máquina rueda más de lo normal o emite sonidos extraños.

No hay tiempo para desmontajes (operación prioritaria).

El equipo es de alto valor o esencial en la línea de producción.

Trabajas en zonas remotas sin infraestructura técnica.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Sin esperas (acción inmediata) | ❌ Retrasos por programación y transporte |

| ✔ Monitoreo preventivo (evitas fallas mayores) | ❌ Suele usarse solo cuando hay emergencias |

| ✔ Ahorro a largo plazo (menos desgaste y reparaciones) | ❌ Gastos periódicos por externalización |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: acceso suficiente para medir y corregir el balance.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Software fácil de usar (con instrucciones visuales y automatizadas).

Análisis en tiempo real (gráficos claros de vibraciones).

Autonomía prolongada (ideales para trabajo en campo).

Ejemplo práctico:

Un molino en una mina comenzó a vibrar peligrosamente. Con un equipo portátil, el técnico localizó el error rápidamente. Lo corrigió añadiendo contrapesos y evitó una parada de 3 días.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Organización visual facilita la comprensión.

– Enfoque práctico: Se añaden ejemplos reales y comparaciones concretas.

– Lenguaje persuasivo: Frases como “herramienta estratégica” o “minimizas riesgos importantes” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más comercial) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

¡Vendemos equipos de equilibrio!

Fabricamos directamente, elaborando en tres ubicaciones al mismo tiempo: España, Argentina y Portugal.

✨Ofrecemos equipos altamente calificados y debido a que somos productores directos, nuestro precio es inferior al de nuestros competidores.

Realizamos envíos a todo el mundo a cualquier país, revise la información completa en nuestra plataforma digital.

El equipo de equilibrio es móvil, ligero, lo que le permite ajustar cualquier elemento giratorio en cualquier condición.

У нас вы можете найти учебные пособия для школьников.

Все школьные дисциплины в одном месте с учетом современных требований.

Успешно сдайте тесты с использованием пробных вариантов.

https://www.t24.su/gdz-polza-ili-vred/

Демонстрационные варианты помогут разобраться с темой.

Доступ свободный для максимальной доступности.

Применяйте на уроках и повышайте успеваемость.

Equilibrio in situ

El Balanceo de Componentes: Elemento Clave para un Desempeño Óptimo

¿ En algún momento te has dado cuenta de movimientos irregulares en una máquina? ¿O tal vez escuchaste ruidos anómalos? Muchas veces, el problema está en algo tan básico como un desequilibrio en alguna pieza rotativa . Y créeme, ignorarlo puede costarte caro .

El equilibrado de piezas es una tarea fundamental tanto en la fabricación como en el mantenimiento de maquinaria agrícola, ejes, volantes, rotores y componentes de motores eléctricos . Su objetivo es claro: evitar vibraciones innecesarias que pueden causar daños serios a largo plazo .

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene una llanta mal nivelada . Al acelerar, empiezan las vibraciones, el volante tiembla, e incluso puedes sentir incomodidad al conducir . En maquinaria industrial ocurre algo similar, pero con consecuencias aún peores :

Aumento del desgaste en bearings y ejes giratorios

Sobrecalentamiento de partes críticas

Riesgo de averías súbitas

Paradas imprevistas que exigen arreglos costosos

En resumen: si no se corrige a tiempo, una mínima falla podría derivar en una situación compleja.

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Recomendado para componentes que rotan rápidamente, por ejemplo rotores o ejes. Se realiza en máquinas especializadas que detectan el desequilibrio en múltiples superficies . Es el método más preciso para garantizar un funcionamiento suave .

Equilibrado estático

Se usa principalmente en piezas como ruedas, discos o volantes . Aquí solo se corrige el peso excesivo en una sola superficie . Es ágil, práctico y efectivo para determinados sistemas.

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se quita peso en el punto sobrecargado

Colocación de contrapesos: como en ruedas o anillos de volantes

Ajuste de masas: común en cigüeñales y otros componentes críticos

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones económicas pero potentes, tales como:

✅ Balanset-1A — Tu aliado portátil para equilibrar y analizar vibraciones

analizador de vibrasiones

Equilibrado dinámico portátil:

Soluciones rápidas sin desmontar máquinas

Imagina esto: tu rotor inicia con movimientos anormales, y cada minuto de inactividad cuesta dinero. ¿Desmontar la máquina y esperar días por un taller? Olvídalo. Con un equipo de equilibrado portátil, solucionas el problema in situ en horas, preservando su ubicación.

¿Por qué un equilibrador móvil es como un “herramienta crítica” para máquinas rotativas?

Pequeño, versátil y eficaz, este dispositivo es la herramienta que todo técnico debería tener a mano. Con un poco de práctica, puedes:

✅ Prevenir averías mayores al detectar desbalances.

✅ Reducir interrupciones no planificadas.

✅ Trabajar en lugares remotos, desde plataformas petroleras hasta plantas eólicas.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Tener acceso físico al elemento rotativo.

– Instalar medidores sin obstáculos.

– Ajustar el peso (añadiendo o removiendo masa).

Casos típicos donde conviene usarlo:

La máquina rueda más de lo normal o emite sonidos extraños.

No hay tiempo para desmontajes (operación prioritaria).

El equipo es difícil de parar o caro de inmovilizar.

Trabajas en áreas donde no hay asistencia mecánica disponible.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Sin esperas (acción inmediata) | ❌ Retrasos por programación y transporte |

| ✔ Mantenimiento proactivo (previenes daños serios) | ❌ Solo se recurre ante fallos graves |

| ✔ Ahorro a largo plazo (menos desgaste y reparaciones) | ❌ Costos recurrentes por servicios |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: acceso suficiente para medir y corregir el balance.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Aplicaciones didácticas (para usuarios nuevos o técnicos en formación).

Análisis en tiempo real (gráficos claros de vibraciones).

Batería de larga duración (perfecto para zonas remotas).

Ejemplo práctico:

Un molino en una mina mostró movimientos inusuales. Con un equipo portátil, el técnico detectó un desbalance en 20 minutos. Lo corrigió añadiendo contrapesos y evitó una parada de 3 días.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Formato claro ayuda a captar ideas clave.

– Enfoque práctico: Incluye casos ilustrativos y contrastes útiles.

– Lenguaje persuasivo: Frases como “recurso vital” o “evitas fallas mayores” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más técnico) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

Analizador de vibrasiones

La máquina de equilibrado Balanset-1A representa el fruto de décadas de investigación y compromiso.

Como desarrolladores de esta herramienta puntera, estamos orgullosos de cada unidad que sale de nuestras fábricas.

No solo es un producto, sino una solución que hemos optimizado para solucionar desafíos importantes relacionados con oscilaciones en equipos giratorios.

Entendemos cuán agotador resulta enfrentar interrupciones repentinas o mantenimientos caros.

Por eso creamos Balanset 1A enfocándonos en las demandas específicas de los usuarios finales. ❤️

Comercializamos Balanset-1A desde las oficinas centrales en nuestras sedes en Portugal , España y Argentina , garantizando despachos ágiles y confiables a todos los países del globo.

Los colaboradores en cada zona están siempre disponibles para brindar soporte técnico personalizado y consultoría en el idioma local.

¡No somos solo una empresa, sino un grupo humano que está aquí para ayudarte!

El Equilibrado de Piezas: Clave para un Funcionamiento Eficiente

¿ En algún momento te has dado cuenta de movimientos irregulares en una máquina? ¿O tal vez escuchaste ruidos anómalos? Muchas veces, el problema está en algo tan básico como una irregularidad en un componente giratorio . Y créeme, ignorarlo puede costarte más de lo que imaginas.

El equilibrado de piezas es una tarea fundamental tanto en la fabricación como en el mantenimiento de maquinaria agrícola, ejes, volantes, rotores y componentes de motores eléctricos . Su objetivo es claro: impedir oscilaciones que, a la larga, puedan provocar desperfectos graves.

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene una rueda desequilibrada . Al acelerar, empiezan las vibraciones, el volante tiembla, e incluso puedes sentir incomodidad al conducir . En maquinaria industrial ocurre algo similar, pero con consecuencias mucho más graves :

Aumento del desgaste en cojinetes y rodamientos

Sobrecalentamiento de componentes

Riesgo de colapsos inesperados

Paradas sin programar seguidas de gastos elevados

En resumen: si no se corrige a tiempo, una mínima falla podría derivar en una situación compleja.

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Perfecto para elementos que operan a velocidades altas, tales como ejes o rotores . Se realiza en máquinas especializadas que detectan el desequilibrio en varios niveles simultáneos. Es el método más fiable para lograr un desempeño estable.

Equilibrado estático

Se usa principalmente en piezas como neumáticos, discos o volantes de inercia. Aquí solo se corrige el peso excesivo en una sola superficie . Es rápido, sencillo y eficaz para ciertos tipos de maquinaria .

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se perfora la región con exceso de masa

Colocación de contrapesos: por ejemplo, en llantas o aros de volantes

Ajuste de masas: habitual en ejes de motor y partes relevantes

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones económicas pero potentes, tales como:

✅ Balanset-1A — Tu compañero compacto para medir y ajustar vibraciones

sg vape

Vaping in Singapore: More Than Just a Trend

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become an essential part of their routine . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a new kind of chill . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for people on the move who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one sleek little package . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s enhanced user experience.

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with dual mesh coils, so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a smart investment . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Zero-Nicotine Line gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re taking your first puff, or a regular enthusiast , the experience is all about what feels right to you — uniquely yours .

Comercializamos máquinas para balanceo!

Somos fabricantes, elaborando en tres ubicaciones al mismo tiempo: Portugal, Argentina y España.

✨Contamos con maquinaria de excelente nivel y como no somos vendedores sino fabricantes, nuestro precio es inferior al de nuestros competidores.

Realizamos envíos a todo el mundo en cualquier lugar del planeta, revise la información completa en nuestra plataforma digital.

El equipo de equilibrio es móvil, de bajo peso, lo que le permite balancear cualquier eje rotativo en diversos entornos laborales.

The Rise of Vaping in Singapore: Not Just a Fad

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become a go-to ritual . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a unique form of downtime . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for those who value simplicity who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one compact design . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s enhanced user experience.

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with a built-in screen , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a better deal . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the 0% Nicotine Series gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re just starting out , or a long-time fan, the experience is all about what feels right to you — tailored to your preferences .

Kingcobratoto login

Why Choose DDoS.Market?

High-Quality Attacks – Our team ensures powerful and effective DDoS attacks for accurate security testing.

Competitive Pricing & Discounts – We offer attractive deals for returning customers.

Trusted Reputation – Our service has earned credibility in the Dark Web due to reliability and consistent performance.

Who Needs This?

Security professionals assessing network defenses.

Businesses conducting penetration tests.

IT administrators preparing for real-world threats.

Vaping Culture in Singapore: A Lifestyle Beyond the Hype

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become a preferred method . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a new kind of chill . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for busy individuals who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one portable solution . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s smarter designs .

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with adjustable airflow , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a smart investment . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Pure Flavor Collection gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re new to the scene , or a long-time fan, the experience is all about what feels right to you — tailored to your preferences .

Vipertoto alternatif

vapesg

The Rise of Vaping in Singapore: Not Just a Fad

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become a daily habit. In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a fresh way to relax . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for users who want instant satisfaction who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one portable solution . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s colder hits .

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with adjustable airflow , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a great value choice. No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Pure Flavor Collection gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re just starting out , or a long-time fan, the experience is all about what feels right to you — your way, your flavor, your style .

truyện tranh

Vaping in Singapore: More Than Just a Trend

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become a daily habit. In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a fresh way to relax . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for busy individuals who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one compact design . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s colder hits .

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with a built-in screen , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a better deal . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Pure Flavor Collection gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re taking your first puff, or an experienced user , the experience is all about what feels right to you — your way, your flavor, your style .

link cucukakek89

vipertoto

Сертификация и лицензии — ключевой аспект ведения бизнеса в России, обеспечивающий защиту от непрофессионалов.

Декларирование продукции требуется для подтверждения безопасности товаров.

Для 49 видов деятельности необходимо специальных разрешений.

https://ok.ru/group/70000034956977/topic/158905167624369

Нарушения правил ведут к приостановке деятельности.

Добровольная сертификация помогает повысить доверие бизнеса.

Соблюдение норм — залог успешного развития компании.

טלגראס כיוונים

שירותי טלגרם|המדריך המלא לקניית קנאביס באופן יעיל

כיום, יישום כלי טכנולוגיים עוזר לנו להפוך תהליכים מורכבים לפשוטים משמעותית. תכנית השימוש הנפוצה ביותר בתחום הקנאביס בישראל הוא מערכת הטלגראס , שמאפשר למשתמשים למצוא ולהזמין קנאביס בצורה מהירה ובטוחה באמצעות אפליקציה של טלגרם. במדריך זה נסביר על מה מדובר בשירות הזה, כיצד הוא עובד, וכיצד תוכלו להשתמש בו כדי להתארגן בצורה הטובה ביותר.

על מה מבוססת שירות טלגראס?

טלגראס כיוונים הוא אתר מידע שמשמש כמרכז עבור משתמשי טלגראס (קבוצות וערוצים באפליקציה של טלגרם) המתמקדים בהזמנת ושילוח קנאביס. האתר מספק רשימות מאומתות לערוצים איכותיים ברחבי הארץ, המאפשרים למשתמשים להזמין קנאביס בצורה נוחה ומהירה.

ההרעיון הבסיסי מאחורי טלגראס כיוונים הוא לחבר בין צרכנים לבין שליחים או סוחרים, תוך שימוש בכלי הטכנולוגיה של האפליקציה הדיגיטלית. כל מה שאתם צריכים לעשות הוא לבחור ערוץ מתאים, ליצור קשר עם הספק הקרוב למקום מגוריכם, ולבקש את המשלוח שלכם – הכל נעשה באופן דיגיטלי ומהיר.

איך работает טלגראס כיוונים?

השימוש בטulgראס כיוונים הוא מובנה בצורה אינטואיטיבית. הנה השלבים הבסיסיים:

גישה למרכז המידע:

הכינו עבורכם את דף התמיכה עבור טלגראס כיוונים, שבו תוכלו למצוא את כל הקישורים המעודכנים לערוצים פעילים וממומלצים. האתר כולל גם הוראות מפורטות כיצד לפעול נכון.

בחירת ערוץ מתאים:

האתר מספק רשימה של ערוצים מומלצים שעוברים בדיקת איכות. כל ערוץ אומת על ידי משתמשים מקומיים ששלחו המלצות, כך שתדעו שאתם נכנסים לערוץ איכותי ונוח.

קישור ישיר לספק:

לאחר בחירת הערוץ המתאים, תוכלו ליצור קשר עם האחראי על השילוח. השליח יקבל את ההזמנה שלכם וישלח לכם את המוצר תוך דקות ספורות.

הגעת המשלוח:

אחת ההפרטים הקריטיים היא שהמשלוחים נעשים בזמן ובאיכות. השליחים עובדים בצורה יעילה כדי להבטיח שהמוצר יגיע אליכם בדיוק.

מדוע זה שימושי?

השימוש בטulgראס כיוונים מציע מספר יתרונות מרכזיים:

פשטות: אין צורך לצאת מהבית או לחפש ספקים באופן עצמאי. כל התהליך מתבצע דרך הפלטפורמה.

מהירות: הזמנת המשלוח נעשית בקצב מהיר, והשליח בדרך אליכם בתוך זמן קצר מאוד.

וודאות: כל הערוצים באתר עוברות בדיקה קפדנית על ידי משתמשים אמיתיים.

נגישות ארצית: האתר מספק קישורים לערוצים אמינים בכל חלקי המדינה, מהקצה אחד של המדינה ועד השני.

למה כדאי לבדוק ערוצים?

אחד הדברים החיוניים ביותר בעת использование טulgראס כיוונים הוא לוודא שאתם נכנסים לערוצים מאומתים. ערוצים אלו עברו בדיקה קפדנית ונבדקו על ידי צרכנים שדיווחו על הביצועים והאיכות. זה מבטיח לכם:

חומרים ברמה גבוהה: השליחים והסוחרים בערוצים המאומתים מספקים מוצרים באיכות גבוהה.

ביטחון: השימוש בערוצים מאומתים מפחית את הסיכון להטעייה או לתשלום עבור מוצרים שאינם עומדים בתיאור.

תמיכה טובה: השליחים בערוצים המומלצים עובדים בצורה מקצועית ומספקים שירות מדויק וטוב.

האם זה מותר לפי החוק?

חשוב לציין כי השימוש בשירותים כמו טulgראס כיוונים אינו חוקי לפי החוק הישראלי. למרות זאת, רבים בוחרים להשתמש בשיטה זו בשל הנוחות שהיא מספקת. אם אתם בוחרים להשתמש בשירותים אלו, חשוב לפעול עם תשומת לב ולבחור ערוצים מאומתים בלבד.

סיכום: איך להתחיל?

אם אתם רוצים להזמין בצורה נוחה להשגת קנאביס בישראל, טulgראס כיוונים עשוי להיות הדרך הנוחה והיעילה. האתר מספק את כל הנתונים, כולל קישורים מעודכנים לערוצים אמינים, מדריכים והסברים כיצד לפעול נכון. עם טulgראס כיוונים, שליח הקנאביס יכול להיות בדרך אליכם בזמן קצר מאוד.

אל תחכו יותר – גשו לאתר המידע שלנו, מצאו את הערוץ המתאים לכם, ותוכלו להנות מחוויית הפעלה מהירה!

טלגראס כיוונים – המקום שבו הקנאביס מגיע עד לדלת ביתכם.

¿Quieres códigos promocionales exclusivos de 1xBet? En este sitio encontrarás recompensas especiales en apuestas deportivas .

La clave 1x_12121 ofrece a hasta 6500₽ al registrarte .

Para completar, utiliza 1XRUN200 y disfruta una oferta exclusiva de €1500 + 150 giros gratis.

https://www.friend007.com/read-blog/218773

Mantente atento las novedades para conseguir recompensas adicionales .

Los promocódigos listados funcionan al 100% para hoy .

¡Aprovecha y maximiza tus ganancias con esta plataforma confiable!

Обязательная сертификация в России необходима для подтверждения качества потребителей, так как минимизирует риски опасной или некачественной продукции на рынок.

Процедуры проверки основаны на технических регламентах, таких как ФЗ № 184-ФЗ, и охватывают как отечественные товары, так и импортные аналоги .

отказное письмо на продукцию Документальное подтверждение гарантирует, что продукция отвечает требованиям безопасности и не повлияет негативно людям и окружающей среде.

Также сертификация стимулирует конкурентоспособность товаров на внутреннем рынке и упрощает к экспорту.

Развитие системы сертификации учитывает современным стандартам, что обеспечивает стабильность в условиях технологических вызовов.

Explore detailed information about the Audemars Piguet Royal Oak Offshore 15710ST here , including market values ranging from $34,566 to $36,200 for stainless steel models.

The 42mm timepiece boasts a robust design with mechanical precision and water resistance , crafted in titanium.

https://ap15710st.superpodium.com

Analyze secondary market data , where limited editions command premiums , alongside rare references from the 1970s.

Get real-time updates on availability, specifications, and investment returns , with trend reports for informed decisions.

טלגראס כיוונים נתניה

טלגראס כיוונים|הדרכות מפורטות לקניית קנאביס באופן יעיל

כיום, השימוש בטכנולוגיות מתקדמות מאפשר לנו להפוך תהליכים מורכבים לפשוטים משמעותית. תכנית השימוש הנפוצה ביותר בתחום הקנאביס בישראל הוא שירותי ההזמנות בטלגרם , שמאפשר למשתמשים למצוא ולהזמין קנאביס בצורה יעילה ומושלמת באמצעות אפליקציה של טלגרם. במסמך זה נסביר על מה מדובר בשירות הזה, כיצד הוא עובד, וכיצד תוכלו להשתמש בו כדי להתארגן בצורה הטובה ביותר.

מה מייצגת מערכת טלגראס?

טלגראס כיוונים הוא מרכז נתונים שמשמש כמרכז עבור משתמשי טלגראס (קבוצות וערוצים בפלטפורמת טלגרם) המתמקדים בהזמנת ושילוח קנאביס. האתר מספק מידע עדכני לערוצים איכותיים ברחבי הארץ, המאפשרים למשתמשים להזמין קנאביס בצורה מובנית היטב.

העיקרון המרכזי מאחורי טלגראס כיוונים הוא לחבר בין לקוחות למפיצים, תוך שימוש בכלי הטכנולוגיה של טלגרם. כל מה שאתם צריכים לעשות הוא לקבוע את הקישור המתאים, ליצור קשר עם הספק הקרוב למקום מגוריכם, ולבקש את המשלוח שלכם – הכל נעשה באופן מבוקר ומדויק.

מהם השלבים לשימוש בשירות?

השימוש בטulgראס כיוונים הוא מובנה בצורה אינטואיטיבית. הנה ההוראות הראשוניות:

גישה למרכז המידע:

הכינו עבורכם את דף התמיכה עבור טלגראס כיוונים, שבו תוכלו למצוא את כל הקישורים המעודכנים לערוצים שעברו בדיקה ואימות. האתר כולל גם הדרכות מובנות כיצד לפעול נכון.

איתור הערוץ הטוב ביותר:

האתר מספק נתוני ערוצים אמינים שעוברים בדיקה קפדנית. כל ערוץ אומת על ידי לקוחות קודמים ששלחו המלצות, כך שתדעו שאתם נכנסים לערוץ איכותי ונוח.

בקשת שיחה עם מזמין:

לאחר בחירה מהרשימה, תוכלו ליצור קשר עם השליח הקרוב לביתכם. השליח יקבל את ההזמנה שלכם וישלח לכם את המוצר תוך דקות ספורות.

קבלת המשלוח:

אחת ההיתרונות העיקריים היא שהמשלוחים נעשים באופן ממוקד ואמין. השליחים עובדים בצורה יעילה כדי להבטיח שהמוצר יגיע אליכם במועד הנדרש.

מדוע זה שימושי?

השימוש בטulgראס כיוונים מציע מספר תכונות חשובות:

سهولة: אין צורך לצאת מהבית או לחפש ספקים באופן עצמאי. כל התהליך מתבצע דרך הפלטפורמה.

מהירות: הזמנת המשלוח נעשית בקצב מהיר, והשליח בדרך אליכם בתוך זמן קצר מאוד.

וודאות: כל הערוצים באתר עוברות תהליך אימות על ידי צוות מקצועי.

נגישות ארצית: האתר מספק קישורים לערוצים מאומתים בכל אזורים בארץ, מהצפון ועד הדרום.

חשיבות הבחירה בערוצים מאומתים

אחד הדברים הקריטיים ביותר בעת использование טulgראס כיוונים הוא לוודא שאתם נכנסים לערוצים אמינים. ערוצים אלו עברו בדיקה קפדנית ונבדקו על ידי משתמשים אמיתיים על החוויה שלהם. זה מבטיח לכם:

מוצרים טובים: השליחים והסוחרים בערוצים המאומתים מספקים מוצרים באיכות מותאמת לצרכים.

ביטחון: השימוש בערוצים מאומתים מפחית את הסיכון להטעייה או לתשלום עבור מוצרים שאינם עומדים בתיאור.

שירות מקצועי: השליחים בערוצים המומלצים עובדים בצורה מקצועית ומספקים שירות מדויק וטוב.

שאלת החוקיות

חשוב לציין כי השימוש בשירותים כמו טulgראס כיוונים אינו מאושר על ידי הרשויות. למרות זאת, רבים בוחרים להשתמש בשיטה זו בשל היעילות שהיא מספקת. אם אתם בוחרים להשתמש בשירותים אלו, חשוב לפעול עם תשומת לב ולבחור ערוצים מאומתים בלבד.

סיכום: איך להתחיל?

אם אתם מחפשים דרך פשוטה ויעילה להשגת קנאביס בישראל, טulgראס כיוונים עשוי להיות המערכת שתעזור לכם. האתר מספק את כל required details, כולל רשימות מומלצות לערוצים אמינים, מדריכים והסברים כיצד לפעול נכון. עם טulgראס כיוונים, שליח הקנאביס יכול להיות בדרך אליכם תוך דקות ספורות.

אל תחכו יותר – גשו לאתר המידע שלנו, מצאו את הערוץ המתאים לכם, ותוכלו להנות מחוויית קבלת השירות בקלות!

טלגראס כיוונים – הדרך לקבל את המוצר במהירות.

hey there and thank you for your info I ve definitely picked up something new from proper here. I did however expertise several technical issues using this website, since I skilled to reload the web site a lot of occasions previous to I may get it to load properly. I have been pondering in case your hosting is OK? No longer that I’m complaining, however slow loading cases instances will sometimes have an effect on your placement in google and could damage your high-quality rating if ads and ***********|advertising|advertising|advertising and *********** with Adwords. Well I m adding this RSS to my e-mail and could glance out for much extra of your respective fascinating content. Ensure that you update this once more very soon..

Launched in 1999, Richard Mille revolutionized luxury watchmaking with avant-garde design. The brand’s iconic timepieces combine high-tech materials like carbon fiber and titanium to enhance performance.

Drawing inspiration from the aerodynamics of Formula 1, each watch embodies “form follows function”, ensuring lightweight comfort . Collections like the RM 001 Tourbillon set new benchmarks since their debut.

Richard Mille’s experimental research in mechanical engineering yield skeletonized movements crafted for elite athletes.

Pre-loved Richard Mille RM 3502 models

Rooted in innovation, the brand challenges traditions through bespoke complications tailored to connoisseurs.

With a legacy , Richard Mille epitomizes modern haute horlogerie, appealing to global trendsetters.

The Audemars Piguet Royal Oak, redefined luxury watchmaking with its signature angular case and stainless steel craftsmanship .

Ranging from classic stainless steel to diamond-set variants, the collection combines avant-garde design with precision engineering .

Starting at $20,000 to over $400,000, these timepieces cater to both seasoned collectors and newcomers seeking investable art .

Verified Audemars Oak 26240 or shop

The Royal Oak Offshore set benchmarks with robust case constructions, showcasing Audemars Piguet’s relentless innovation.

Thanks to meticulous hand-finishing , each watch reflects the brand’s commitment to excellence .

Explore certified pre-owned editions and detailed collector guides to elevate your collection with this modern legend .

[b]Prevent Vibration Damage – Get Professional Balancing with Balanset-1A[/b]

Unbalanced rotors can cause serious damage to your machinery. Bearings wear out faster, motors consume more power, and failures lead to expensive repairs. [b]Balanset-1A[/b] provides professional-grade vibration diagnostics and balancing, helping businesses save money and improve reliability.

[b]Key Benefits:[/b]

– [b]Accurate & fast diagnostics[/b] – Identifies imbalance before it causes damage

– [b]Portable & efficient[/b] – Suitable for field and workshop use

– [b]User-friendly software[/b] – No special training required

[b]Choose Your Kit:[/b]

[url=https://www.amazon.es/dp/B0DCT5CCKT]Full Kit on Amazon[/url] – Includes all necessary sensors, software, and a protective case

Price: [b]€2250[/b]

[url=https://www.amazon.es/dp/B0DCT5CCKT][img]https://i.postimg.cc/SXSZy3PV/4.jpg[/img][/url]

[url=https://www.amazon.es/dp/B0DCT4P7JR]OEM Kit on Amazon[/url] – More affordable, comes with basic components

Price: [b]€1978[/b]

[url=https://www.amazon.es/dp/B0DCT4P7JR][img]https://i.postimg.cc/cvM9G0Fr/2.jpg[/img][/url]

Protect your equipment today with [b]Balanset-1A[/b]!

Стальные резервуары используются для хранения дизельного топлива и соответствуют стандартам температур до -40°C.

Вертикальные емкости изготавливают из нержавеющих сплавов с усиленной сваркой.

Идеальны для промышленных объектов: хранят бензин, керосин, мазут или авиационное топливо.

Резервуар для АЗС 90 м3

Двустенные резервуары обеспечивают экологическую безопасность, а подземные модификации подходят для разных условий.

Заводы предлагают индивидуальные проекты объемом до 100 м³ с монтажом под ключ.

Die Royal Oak 16202ST vereint ein rostfreies Stahlgehäuse in 39 mm mit einem ultradünnen Profil und dem neuen Kaliber 7121 für lange Energieautonomie.

Das blaue Petite-Tapisserie-Dial mit leuchtenden Stundenmarkern und Royal-Oak-Zeigern wird durch eine Saphirglas-Scheibe mit blendschutzbeschichteter Oberfläche geschützt.

Neben Datum bei 3 Uhr bietet die Uhr bis 5 ATM geschützte Konstruktion und ein geschlossenes Edelstahlband mit verstellbarem Verschluss.

Piguet Audemars Royal Oak 15450st armbanduhren

Die oktogonale Lünette mit ikonenhaften Hexschrauben und die polierte Oberflächenkombination zitieren den legendären Genta-Entwurf.

Als Teil der „Jumbo“-Linie ist die 16202ST eine Sammler-Investition mit einem Preis ab ~75.900 €.

Crafted watches never lose relevance for numerous vital factors.

Their artistic design and legacy set them apart.

They symbolize power and exclusivity while blending functionality with art.

Unlike digital gadgets, they appreciate with age due to exclusive materials.

https://www.provenexpert.com/en-us/apwatch/

Collectors and enthusiasts admire the intricate movements that no smartwatch can replicate.

For many, having them signifies taste that remains eternal.

Коллекция Nautilus, созданная Жеральдом Гентой, сочетает спортивный дух и прекрасное ремесленничество. Модель Nautilus 5711 с самозаводящимся механизмом имеет 45-часовой запас хода и корпус из нержавеющей стали.

Восьмиугольный безель с плавными скосами и синий солнечный циферблат подчеркивают уникальность модели. Браслет с интегрированными звеньями обеспечивает комфорт даже при активном образе жизни.

Часы оснащены индикацией числа в позиции 3 часа и антибликовым покрытием.

Для версий с усложнениями доступны хронограф, вечный календарь и функция Travel Time.

Выбрать часы Патек Филип Nautilus здесь

Например, модель 5712/1R-001 из розового золота с калибром повышенной сложности и запасом хода на двое суток.

Nautilus остается символом статуса, объединяя современные технологии и традиции швейцарского часового дела.

Really enjoyed this update, how can I make is so that I receive an email sent to me when there is a new update?

Slotbom77

На данном сайте вы найдете Telegram-бот “Глаз Бога”, который собрать данные о человеке из открытых источников.

Бот работает по номеру телефона, анализируя публичные материалы в Рунете. С его помощью осуществляется пять пробивов и глубокий сбор по имени.

Платфор ма проверен на 2025 год и включает фото и видео. Глаз Бога гарантирует проверить личность в соцсетях и покажет результаты мгновенно.

глаз бога найти по фото

Такой бот — идеальное решение в анализе граждан онлайн.

עט אידוי נטען

מכשירי אידוי – חידוש משמעותי, נוח וטוב לבריאות למשתמש המודרני.

בעולם המודרני, שבו דחיפות ושגרת יומיום קובעים את היום-יום, וופ פנים הפכו לבחירה מועדפת עבור אלה המעוניינים ב חווית אידוי מקצועית, קלה ובריאה.

מעבר לטכנולוגיה החדשנית שמובנית בהמוצרים האלה, הם מציעים מספר רב של יתרונות בולטים שהופכים אותם לבחירה מועדפת על פני שיטות קונבנציונליות.

עיצוב קומפקטי ונוח לנשיאה

אחד ההיתרונות העיקריים של עטי אידוי הוא היותם קומפקטיים, בעלי משקל נמוך וקלים להעברה. המשתמש יכול לקחת את הVape Pen לכל מקום – למשרד, לטיול או לאירועים – מבלי שהמכשיר יפריע או יתפוס מקום.

הגודל הקטן מאפשר לאחסן אותו בכיס בפשטות, מה שמאפשר שימוש דיסקרטי ונוח יותר.

מתאים לכל המצבים

עטי האידוי בולטים ביכולתם להתאים לצריכה בסביבות מגוונות. בין אם אתם בעבודה או באירוע חברתי, ניתן להשתמש בהם בצורה שקטה ובלתי מפריעה.

אין עשן מציק או ריח עז שמפריע לסביבה – רק אידוי חלק ופשוט שנותן גמישות גם באזור הומה.

שליטה מדויקת בטמפרטורה

למכשירי האידוי רבים, אחד היתרונות המרכזיים הוא היכולת לשלוט את חום הפעולה באופן מדויק.

מאפיין זה מאפשרת לכוונן את השימוש להמוצר – קנאביס טבעי, נוזלי אידוי או תמציות – ולבחירת המשתמש.

שליטה טמפרטורתית מספקת חוויית אידוי חלקה, טהורה ואיכותית, תוך שימור על הטעמים המקוריים.

צריכה בריאה וטוב יותר

בניגוד לעישון מסורתי, אידוי באמצעות עט אידוי אינו כולל שריפה של המוצר, דבר שמוביל למינימום של חומרים מזהמים שמשתחררים במהלך השימוש.

נתונים מראים על כך שוופינג הוא פתרון טוב יותר, עם פחות חשיפה לחלקיקים מזיקים.

בנוסף, בשל היעדר שריפה, הטעמים ההמקוריים נשמרים, מה שמוסיף להנאה מהמוצר וה�נאה הכוללת.

קלות שימוש ואחזקה

מכשירי הוופ מיוצרים מתוך עיקרון של קלות שימוש – הם מתאימים הן לחדשים והן למשתמשים מנוסים.

מרבית המוצרים מופעלים בלחיצה אחת, והתכנון כולל החלפה של רכיבים (כמו מיכלים או גביעים) שמפשטים על התחזוקה והאחזקה.

תכונה זו מגדילה את חיי המכשיר ומספקת ביצועים תקינים לאורך זמן.

סוגים שונים של מכשירי וופ – התאמה אישית

הבחירה רחבה בוופ פנים מאפשר לכל משתמש ללמצוא את המכשיר המתאים ביותר עבורו:

מכשירים לקנאביס טבעי

מי שמעוניין ב חווית אידוי אותנטית, ללא תוספים – ייבחר מכשיר לקנאביס טחון.

המכשירים הללו מיועדים לעיבוד בחומר גלם טבעי, תוך שימור מקסימלי על הריח והטעימות ההמקוריים של הקנאביס.

עטי אידוי לשמנים ותמציות

למשתמשים שרוצים אידוי עוצמתי ומלא ברכיבים כמו THC וקנאבידיול – קיימים עטים המתאימים במיוחד לנוזלים ותמציות.

המוצרים האלה מתוכננים לשימוש בחומרים צפופים, תוך יישום בחידושים כדי ללספק אידוי אחיד, חלק ועשיר.

—

מסקנות

מכשירי וופ אינם רק עוד כלי לשימוש בקנאביס – הם סמל לאיכות חיים, לגמישות ולהתאמה לצרכים.

בין היתרונות המרכזיים שלהם:

– עיצוב קטן ונעים לנשיאה

– ויסות חכם בחום האידוי

– חווית אידוי נקייה ונטולת רעלים

– הפעלה אינטואיטיבית

– מגוון רחב של התאמה לצרכים

בין אם זו הההתנסות הראשונה בעולם האידוי ובין אם אתם משתמש מנוסה – וופ פן הוא ההמשך הלוגי לצריכה איכותית, מהנה ובטוחה.

—

הערות:

– השתמשתי בספינים כדי ליצור וריאציות טקסטואליות מגוונות.

– כל האפשרויות נשמעות טבעיות ומתאימות לשפה העברית.

– שמרתי על כל המושגים ספציפיים (כמו Vape Pen, THC, CBD) ללא שינוי.

– הוספתי כותרות כדי לשפר את ההבנה והסדר של הטקסט.

הטקסט מתאים למשתמשים בישראל ומשלב שפה שיווקית עם מידע מקצועי.

Здесь можно получить сервис “Глаз Бога”, позволяющий собрать всю информацию о человеке по публичным данным.

Инструмент работает по ФИО, обрабатывая доступные данные в Рунете. Благодаря ему осуществляется 5 бесплатных проверок и детальный анализ по запросу.

Платфор ма актуален на август 2024 и охватывает аудио-материалы. Глаз Бога гарантирует проверить личность по госреестрам и отобразит сведения мгновенно.

телеграм бот глаз бога проверка

Такой бот — выбор в анализе людей удаленно.

Здесь можно получить мессенджер-бот “Глаз Бога”, который проверить всю информацию о гражданине через открытые базы.

Инструмент работает по номеру телефона, используя доступные данные онлайн. Через бота доступны бесплатный поиск и глубокий сбор по фото.