Retirement age policies vary widely across the globe and play a crucial role in the economic and social structures of each country. Typically, retirement age is influenced by factors such as life expectancy, healthcare quality, and financial stability.

In wealthier nations, where life expectancy is generally higher, retirement ages tend to be set later, allowing for longer working lives and helping to alleviate the financial burden on social security systems. Meanwhile, countries with lower life expectancies or different economic models may adopt earlier retirement ages.

The differences in retirement age also reflect varying cultural attitudes towards work and the expectations of later-life financial support. For instance, in some European countries, strong social welfare programs support retirees, allowing for a more flexible approach to retirement.

Retirement Ages in Different Countries

| Country | Retirement Age |

|---|---|

| Australia | 67 |

| Denmark | 67 |

| Greece | 67 |

| Iceland | 67 |

| Israel | 67 |

| Italy | 67 |

| Netherlands | 67 |

| United States | 66.67 |

| Spain | 66.5 |

| Portugal | 66.33 |

| Germany | 66 |

| Ireland | 66 |

| United Kingdom | 66 |

| Cyprus | 65.5 |

| Albania | 65 |

| Austria | 65 |

| Azerbaijan | 65 |

| Belgium | 65 |

| Brazil | 65 |

| Canada | 65 |

| Chile | 65 |

| Croatia | 65 |

| Georgia | 65 |

| Hong Kong | 65 |

| Hungary | 65 |

| Liechtenstein | 65 |

| Luxembourg | 65 |

| Mexico | 65 |

| New Zealand | 65 |

| Poland | 65 |

| Romania | 65 |

| Serbia | 65 |

| Switzerland | 65 |

| Euro Area | 64.97 |

| European Union | 64.92 |

| Estonia | 64.75 |

| Latvia | 64.75 |

| Lithuania | 64.67 |

| Bulgaria | 64.58 |

| Finland | 64.5 |

| Czech Republic | 64.33 |

| Japan | 64 |

| Malta | 64 |

| Armenia | 63 |

| Belarus | 63 |

| Kazakhstan | 63 |

| Moldova | 63 |

| Russia | 63 |

| Singapore | 63 |

| Slovakia | 63 |

| Sweden | 63 |

| Tajikistan | 63 |

| France | 62.5 |

| Norway | 62 |

| Turkmenistan | 62 |

| Vietnam | 61 |

| Algeria | 60 |

| China | 60 |

| India | 60 |

| Malaysia | 60 |

| Micronesia | 60 |

| Mongolia | 60 |

| Saudi Arabia | 60 |

| Slovenia | 60 |

| South Africa | 60 |

| South Korea | 60 |

| Turkey | 60 |

| Ukraine | 60 |

| Uzbekistan | 60 |

| Bangladesh | 59 |

| Indonesia | 58 |

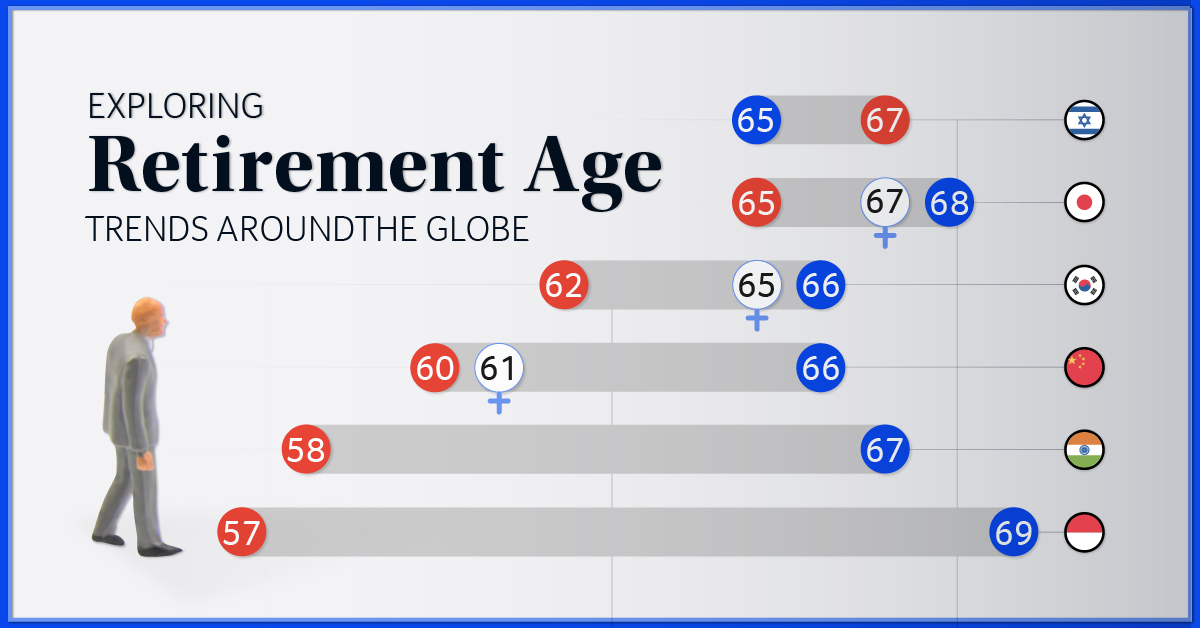

On the other hand, some countries, especially in Asia, encourage continued participation in the workforce, even in later years, which is partly influenced by cultural views on productivity and family support structures.

Read : From The Little Mermaid to Tivoli Gardens: Essential Stops for Every Denmark Itinerary

Policy changes around retirement age have become increasingly common as many nations face demographic shifts and aging populations. These shifts mean that more people are reaching retirement age at the same time as younger generations are shrinking, creating additional financial strain on social systems.

Read : China Raises Retirement Age for the First Time Since the 1950s

To address this, several countries are gradually raising the retirement age or implementing phased retirement options to allow older workers to stay engaged in the workforce while easing into retirement. This approach helps to ensure the sustainability of retirement benefits for future generations.

Here’s a table with the top ten countries based on their highest age of retirement :

| Rank | Country | Retirement Age |

|---|---|---|

| 1 | Australia | 67 |

| 2 | Denmark | 67 |

| 3 | Greece | 67 |

| 4 | Iceland | 67 |

| 5 | Israel | 67 |

| 6 | Italy | 67 |

| 7 | Netherlands | 67 |

| 8 | United States | 66.67 |

| 9 | Spain | 66.5 |

| 10 | Portugal | 66.33 |

This ranking highlights the countries where individuals are expected to retire at a later age, reflecting the countries’ policies on extended working years due to higher life expectancy and economic factors.

Global retirement age policies reveal a fascinating intersection of economics, cultural values, and social security considerations. While countries like Australia, Denmark, and the Netherlands have pushed retirement ages higher to address aging populations and support economic stability, others maintain more traditional retirement ages.

These policies are not only about economic strategy but also reflect each nation’s unique approach to supporting its citizens in later life. As populations continue to age globally, retirement policies will likely keep evolving, balancing the need for sustainable social security systems with the goal of ensuring a dignified and well-supported retirement for all.