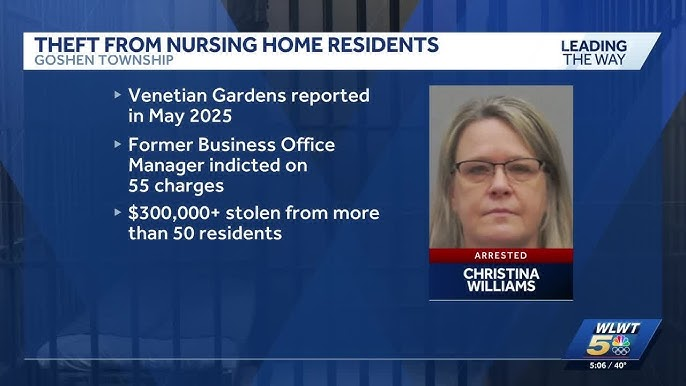

Authorities have filed dozens of criminal charges against a former nursing home employee accused of carrying out a prolonged financial exploitation scheme targeting elderly residents. The case centers on allegations that 51-year-old Christina Williams, who previously served as a Business Office Manager at Venetian Gardens Nursing Home, stole more than $300,000 from resident accounts over a period spanning several years. Investigators say the suspected misconduct involved more than 50 individuals, many of whom were part of a legally protected class due to age or vulnerability.

The charges follow a detailed investigation initiated after nursing home administrators reported concerns about financial irregularities. Law enforcement officials describe the case as significant not only for the scale of the alleged theft but also for the level of trust placed in the accused employee’s role within the facility. As legal proceedings begin, the situation has raised serious questions about oversight, safeguards, and the broader risks facing elderly residents in institutional care settings.

How the Investigation Began and What Authorities Discovered

The case first came to the attention of law enforcement in May of last year, when the Goshen Township Police Department received a report from Venetian Gardens Nursing Home regarding suspected financial misconduct by a former employee. According to authorities, administrators had identified irregularities in resident financial records that prompted internal concern. Nursing home staff then alerted police, initiating what would become a lengthy and complex investigation involving financial records, account audits, and interviews.

Officials say the investigation required careful review of numerous resident accounts managed or accessed by Christina Williams during her time as Business Office Manager. In that role, she was responsible for handling administrative and financial matters related to resident billing, account maintenance, and other monetary transactions. Such responsibilities typically involve managing funds that residents or their families entrust to the facility for safekeeping and payment of care-related expenses. Investigators focused on identifying patterns of unexplained withdrawals, transfers, or discrepancies tied to those accounts.

Over time, police say the evidence revealed an extensive pattern of alleged unauthorized transactions affecting more than 50 residents. Authorities estimate the total amount taken exceeded $300,000, making the case notable both for its duration and its scale. Investigators believe the activity occurred gradually over several years, suggesting that the alleged scheme involved repeated financial manipulation rather than isolated incidents.

The findings were presented to a grand jury, which returned an indictment charging Christina Williams with 56 counts of felony theft from a person in a protected class. Such charges reflect the legal recognition that elderly or otherwise vulnerable individuals require additional safeguards under the law. Prosecutors typically pursue enhanced penalties in cases involving exploitation of individuals who may be less able to monitor their finances or detect irregularities.

Read : Nurse Stephanie Krueger Under Fire After Controversial TikTok Video

Police have stated that the investigation remains ongoing, indicating that authorities may still be reviewing records, identifying potential additional victims, or examining related financial activity. The complexity of cases involving multiple victims and extended timelines often requires continued forensic accounting work even after initial charges are filed.

Read : Bizarre!!! Man Bites Snake Twice Who Bit Him Once: Snake Dies

Throughout the investigation, law enforcement officials reported that Venetian Gardens staff cooperated fully, providing documentation and access to financial records. Authorities have emphasized that such cooperation was essential in reconstructing account histories and identifying potential losses.

The Role of Financial Oversight in Long-Term Care Facilities

Cases involving alleged financial exploitation within nursing homes draw attention to the critical importance of financial oversight systems in long-term care settings. Residents in such facilities often rely on staff members to manage or assist with financial matters, particularly when mobility limitations, cognitive decline, or medical conditions make independent financial management difficult. This reliance can create situations in which staff hold significant authority over funds, requiring strict accountability mechanisms.

Business office personnel in nursing homes typically handle sensitive financial responsibilities, including billing for services, managing resident trust accounts, processing payments, and maintaining records. Because these functions involve access to resident funds, facilities generally implement internal controls such as audit procedures, transaction documentation requirements, and supervisory review. These safeguards are designed to detect irregularities quickly and prevent unauthorized financial activity.

However, oversight systems can vary widely depending on the size of the facility, staffing levels, and administrative structure. Smaller or understaffed facilities may face greater challenges in maintaining frequent audits or cross-checking transactions. Even in well-regulated environments, long-term schemes can sometimes go undetected if transactions are small, spread out over time, or concealed within complex billing systems.

Experts in elder care administration often emphasize the importance of layered monitoring practices. These may include regular internal audits, independent external reviews, mandatory dual authorization for financial transfers, and routine reconciliation of resident trust accounts. In addition, transparency measures such as providing families with periodic account statements can serve as an additional protective mechanism.

Training and supervision of employees also play a critical role. Staff who manage finances must understand not only procedural requirements but also ethical obligations and legal consequences associated with misuse of funds. Facilities may also implement background checks and credential verification for individuals placed in financial management roles.

When alleged exploitation occurs despite such safeguards, it can prompt broader scrutiny of policies and procedures. Facilities may conduct internal reviews to determine whether warning signs were missed or whether improvements to monitoring systems are necessary. Regulatory bodies may also examine compliance with state or federal guidelines governing resident financial protection.

Legal Implications and Community Response

The indictment against Christina Williams carries significant legal implications due to the number of counts and the nature of the alleged victims. Theft from individuals classified as part of a protected group often results in more severe criminal penalties than similar offenses involving the general population. Prosecutors typically argue that such crimes involve a breach of trust and exploitation of individuals who may have limited ability to safeguard their own finances.

Read : Prison Nurse Kymberley Finn Struck Off After Smuggling Mobile Phone into Prison

Each count of felony theft represents a separate alleged instance of unlawful taking, meaning that the case involves numerous individual allegations tied to specific residents or transactions. The cumulative nature of these charges reflects the scale of the alleged conduct and may influence sentencing outcomes if convictions occur.

Law enforcement officials have publicly emphasized their commitment to protecting vulnerable community members. Statements from the police department have highlighted the importance of accountability in cases involving alleged financial abuse of elderly individuals. Such messaging is often intended to reassure families of nursing home residents that reports of suspected wrongdoing will be investigated thoroughly.

The response from the nursing home itself has focused on cooperation with authorities and support for the investigation. Facilities facing situations like this often work to demonstrate transparency and responsiveness, particularly when resident trust is at stake. Families of residents may seek assurances regarding financial safeguards, monitoring procedures, and communication practices moving forward.

Cases involving alleged financial exploitation in care settings can have lasting emotional and psychological effects beyond monetary loss. Families may experience diminished confidence in institutional care, and residents may feel anxiety about financial security. For this reason, investigations and legal proceedings often carry broader community significance beyond the courtroom.

As the legal process continues, further developments may clarify the full extent of the alleged conduct and any systemic issues that may have contributed to the situation. Court proceedings will determine how the charges are resolved and whether additional measures or reforms emerge in response. The investigation remains active, and authorities continue to review evidence and gather information related to the case. The outcome will ultimately depend on the judicial process, which will examine the allegations, evidence, and legal arguments presented by both prosecution and defense.