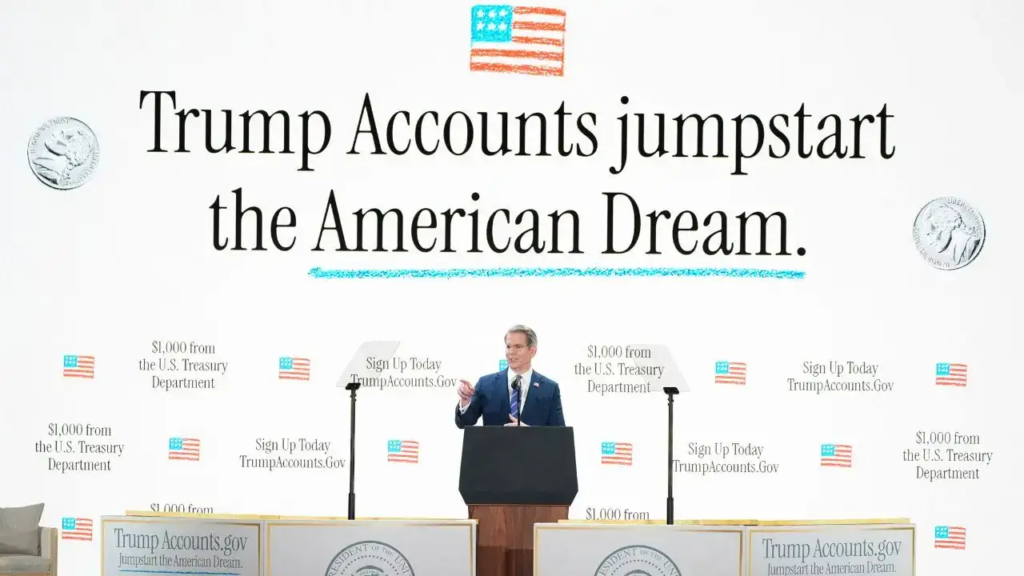

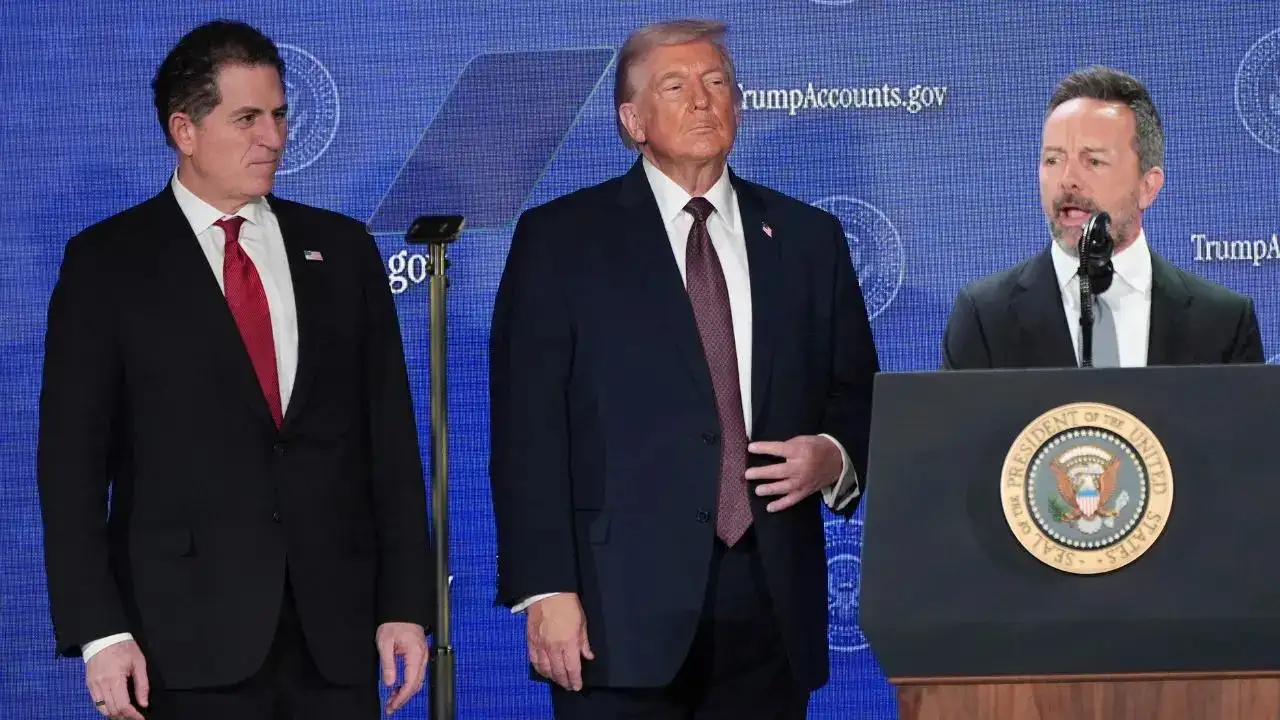

Brad Gerstner has emerged as one of the most influential figures at the intersection of finance, technology and public policy in the United States. Best known as the founder and chief executive of Altimeter Capital, Gerstner has built a reputation as a sharp investor with a strong interest in long-term economic structures rather than short-term market cycles. In recent years, his influence has extended beyond Wall Street into the policy arena, culminating in his role in shaping the so-called “Trump Accounts,” a federal initiative designed to encourage wealth-building from birth.

The programme, which provides a $1,000 government-funded deposit into tax-advantaged investment accounts for children born between 2025 and 2028, represents a significant experiment in early-life financial inclusion. Gerstner’s involvement has drawn attention not only to the mechanics of the policy but also to the broader philosophy that underpins his career: the belief that access to capital, when paired with long-term investing, can meaningfully narrow the wealth gap.

Brad Gerstner’s Career in Finance and Technology

Bradley Thomas Gerstner is an American entrepreneur, hedge fund manager, venture capitalist and investor who has spent decades navigating global markets. He is the founder, chairman and chief executive of Altimeter Capital, an investment firm known for its focus on technology-driven growth companies. Altimeter has invested across both public and private markets, with notable stakes in firms such as Snowflake and Grab, bets that cemented Gerstner’s standing as a high-profile technology investor.

His investment approach has consistently emphasised long-term value creation rather than short-term speculation. This philosophy has placed him among a cohort of investors who see technology as a structural driver of economic transformation rather than a cyclical trend. In recognition of his success, Gerstner appeared on Forbes’ Midas List in 2022, a ranking that highlights the world’s top technology investors.

The listing underscored not only the financial returns achieved by Altimeter but also Gerstner’s influence within Silicon Valley and the broader investment community. Beyond investing, Gerstner has cultivated a public voice through media and commentary.

He co-hosts BG2Pod, a bi-weekly podcast alongside venture capitalist Bill Gurley, where the two discuss technology, markets, investing and capitalism. The podcast has become a platform for long-form conversations about market structure, innovation and policy, allowing Gerstner to articulate views that extend beyond portfolio performance. Through these discussions, he has frequently argued that the US economic system needs reforms that promote broader participation in capital markets.

Brad Gerstner (@altcap) on Trump Accounts: Every child in America, from rural Missouri to rural Indiana, from Trenton to Compton, is going to start off life with an investment account at birth… where they privately own all of the greatest companies in this country… This makes… pic.twitter.com/jlMYdUGErZ

— Rapid Response 47 (@RapidResponse47) January 28, 2026

Gerstner’s career trajectory reflects a blending of traditional hedge fund management with venture capital sensibilities. While many hedge fund managers remain largely focused on financial engineering or trading strategies, Gerstner has positioned himself as an investor concerned with how capital allocation shapes society. This broader outlook laid the groundwork for his later involvement in policy initiatives aimed at expanding access to investing.

The Origins of Trump Accounts and Gerstner’s Role

The idea behind Trump Accounts traces back to a personal moment rather than a policy white paper. Gerstner has explained that the concept was inspired by a conversation with his son, Lincoln, after Gerstner had opened custodial investment accounts for his own children. When Lincoln questioned why some children had access to such accounts while others did not, Gerstner began to reflect on the uneven distribution of financial opportunity in the United States. That exchange became the catalyst for what would later evolve into the Invest America initiative.

In 2025, Gerstner founded the Invest America Foundation, an organisation aimed at advancing legislation that would provide children with early access to investment capital. The foundation played a key role in shaping and promoting the Invest America Act, legislation that ultimately created the framework for the Trump Accounts. The act established tax-advantaged investment accounts seeded with a $1,000 deposit from the US Treasury for children born between January 1, 2025, and December 31, 2028.

The Trump Accounts initiative was developed in collaboration with policymakers during the Donald Trump administration and framed as a pilot programme to encourage long-term saving and investing from birth. The underlying premise is that early exposure to capital markets, combined with decades of compound growth, can produce meaningful financial assets by adulthood. Supporters argue that even a modest initial contribution, if invested over time, could help reduce disparities in wealth accumulation.

Gerstner’s role was not simply advisory. Through Invest America, he actively advocated for the policy, engaging with lawmakers, financial institutions and potential private-sector partners. His efforts helped attract high-profile backing from wealthy individuals and business leaders, including Michael and Susan Dell, hedge fund manager Ray Dalio and musician Nicki Minaj. Their support added both financial credibility and public visibility to the initiative.

By tying the programme to the Trump administration, the accounts became politically branded, but Gerstner has consistently framed the idea as non-partisan in intent. His stated focus has been on structural reform rather than ideology, arguing that early investment accounts could become a foundational element of a more inclusive financial system regardless of which party is in power.

Corporate Support, Policy Impact and the Broader Debate

A defining feature of the Trump Accounts programme has been the level of corporate participation it has attracted, particularly from major financial institutions. JPMorgan Chase and Bank of America, the two largest US banks by assets, announced that they would match the government’s one-time $1,000 contribution for eligible employees’ children. These announcements positioned the banks as early and influential supporters of the initiative.

JPMorgan Chase chief executive Jamie Dimon framed the decision as an extension of the firm’s long-standing commitment to employee financial well-being. By matching the government deposit, the bank aims to make it easier for families to begin saving early and to encourage long-term financial planning. Bank of America echoed similar sentiments in an internal memo, describing the programme as an example of innovative government solutions for employee savings.

Other financial firms have followed suit. BlackRock, BNY, Robinhood, SoFi and Charles Schwab have all pledged to provide matching contributions, according to reports. The concentration of support from financial services companies reflects both the nature of the programme and the industry’s interest in promoting broader participation in investing. For firms that benefit from long-term asset growth, initiatives that bring new generations into capital markets align with strategic as well as social objectives.

The Trump Accounts concept has also sparked debate. Supporters argue that it represents a pragmatic approach to addressing wealth inequality by leveraging the power of compound returns rather than relying solely on redistribution. By giving every eligible child a financial stake at birth, the programme seeks to normalise investing and reduce barriers to entry that disproportionately affect low-income families.

Critics, however, have questioned whether a $1,000 deposit is sufficient to meaningfully address systemic inequality, particularly if families lack the financial literacy or resources to manage the accounts effectively. Others have raised concerns about the political branding of the initiative and whether its long-term survival depends on continued bipartisan support. There is also debate over whether such programmes should prioritise universal coverage or be more targeted toward disadvantaged households.

For Gerstner, these debates underscore the experimental nature of the policy. He has described the accounts as a starting point rather than a complete solution, arguing that early exposure to investing can have cultural as well as financial effects. By making capital ownership a default rather than an exception, the programme aims to shift attitudes toward saving and investing across generations.

Brad Gerstner’s involvement in the creation of Trump Accounts reflects a broader trend of private-sector leaders engaging directly with public policy. His career illustrates how financial expertise, when combined with advocacy and institutional support, can shape national initiatives. Whether Trump Accounts ultimately achieve their stated goal of narrowing the wealth gap remains to be seen, but the programme has already positioned Gerstner as a prominent example of a hedge fund manager whose influence extends well beyond markets and into the architecture of economic opportunity itself.

Hey everyone, giving lotterygamesbet a go! Love lotteries, so hoping for some good luck! Check it out, maybe you will win: lotterygamesbet

Alright folks, diving into ok3655. New platform, let’s see. May the odds be ever in our favor! Check it now: ok3655

Alright, so I stumbled upon jilipark1 the other day and it seems pretty legit. Smooth interface and a decent selection of games. I’d say give it a shot if you’re curious! You know, try your luck at jilipark1