Farmer Protest in London to voice their concerns and frustrations over recent changes to inheritance tax policies. The protest, marked by anger and anxiety, reflects the growing discontent among agricultural communities who fear these measures will endanger their livelihoods and the heritage of family-run farms.

The rally, attended by thousands, underscores the far-reaching implications of the government’s new fiscal policies on rural communities and the farming industry at large.

The Roots of Discontent: Inheritance Tax Changes

The crux of the farmers’ grievances lies in the inheritance tax changes introduced by Chancellor Rachel Reeves in her recent budget announcement. Farms valued at over £1 million are now subjected to a 20% inheritance tax, payable in installments over 10 years, starting April 2026.

While the government claims that allowances effectively raise the threshold to £3 million for most farmers, the policy has stoked fear and uncertainty among the agricultural community.

Jacob Anthony, a fifth-generation farmer from Bridgend, Wales, articulated the deep emotional toll this change has taken on him and his family. His 700-acre hill farm, home to 1,000 breeding ewes and 300 cattle, symbolizes generations of toil and dedication.

“My forefathers would be turning in their graves,” Anthony lamented, expressing concerns about the financial strain the tax could impose. The potential necessity of selling parts of the farm to meet tax obligations looms as a threat to his family’s legacy and the viability of their business.

Would you support the English Farmers doing this in London in Protest over the greedy governments inheritance increases! pic.twitter.com/BufBKQhW5F

— Benonwine (@benonwine) November 3, 2024

Similarly, farmers like Anwen Hughes, who operates two farms in Ceredigion, voiced anxiety about the broader economic implications of the tax. She fears declining land prices, increased challenges in securing loans, and a stifled ability to expand operations, all of which could cripple future prospects for her family’s farming enterprises.

The Protests: Uniting Rural Voices

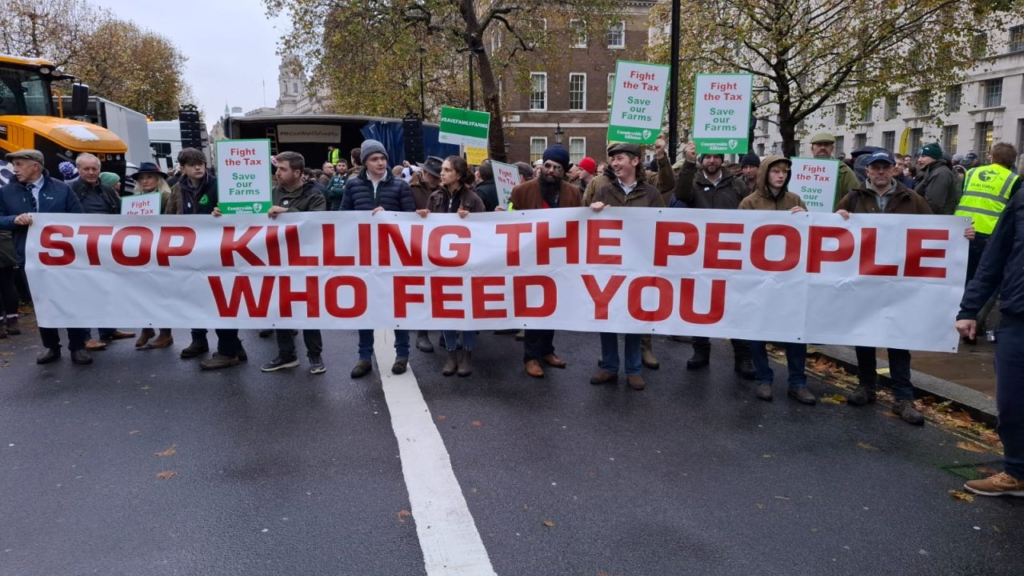

The discontent among farmers has galvanized unprecedented action. Thousands converged on Westminster, arriving in buses organized by farming unions and local communities.

The protest included an official National Farmers’ Union (NFU) mass lobby event, split into several sessions due to overwhelming interest. In addition, a public rally outside the venue, largely coordinated online, brought together a diverse group of stakeholders.

Among the protest leaders was Ioan Humphreys, a fifth-generation sheep, beef, and poultry farmer from Powys. Known for his prominent social media presence, Humphreys emphasized the ripple effect the tax changes could have on rural communities. “It’s not just farmers who will suffer,” he warned. “Mechanics, feed merchants, tractor salesmen – the entire rural economy depends on farming.”

The gathering also saw passionate speeches, banners with slogans like “No Farmers, No Food,” and discussions on the future of the agricultural sector. The sentiment among participants was clear: the government’s tax policy, touted as a measure to address fiscal challenges, risks eroding the backbone of the UK’s rural economy.

Government Response and the Path Forward

Prime Minister Sir Keir Starmer and his government have defended the policy, asserting that only the wealthiest landowners will be impacted. Starmer emphasized that the majority of farms would remain unaffected due to the higher effective threshold. He also highlighted the need to prioritize public services, such as schools, hospitals, and affordable housing, which rely on sustainable fiscal policies.

Despite these assurances, the farming community remains unconvinced. The National Farmers’ Union and other stakeholders have pointed to conflicting data on the policy’s potential impact. While the Treasury estimates that 500 estates annually will be affected, the Department of Environment, Food and Rural Affairs (DEFRA) suggests that two-thirds of farms could fall under the new tax regime.

The row over inheritance tax comes at a time of strained relations between the Labour-run Welsh government and its farming constituency. Earlier protests in February, which drew 3,000 participants, highlighted a broader discontent over subsidies and regulations. With the announcement of a revised farm subsidy scheme on the horizon, the government faces mounting pressure to address farmers’ concerns comprehensively.

The Human Cost of Policy

For many farmers, the issue is not solely financial but deeply personal. The changes threaten a way of life rooted in generational traditions and hard work. As Jacob Anthony’s father, Peter, reflected, “Had inheritance tax been due after my father’s passing, it would have finished the farm as it is.”

This sentiment resonates with farmers like Anwen Hughes and Ioan Humphreys, who see their roles as custodians of a heritage that sustains not just their families but entire communities. The fear of being forced to sell land, reduce operations, or abandon farming altogether has created an atmosphere of uncertainty and frustration.

The protests in London represent more than a reaction to a single policy; they are a clarion call for greater understanding and empathy from policymakers. The farming community seeks recognition of the complexities and challenges inherent in their work, as well as policies that support, rather than hinder, their contributions to society.

A Tense Crossroads

As the UK government moves forward with its inheritance tax policy, it must grapple with the growing discontent among farmers and their allies. The protest in London serves as a stark reminder of the importance of balancing fiscal responsibility with the needs of rural communities.

While the government argues that the policy is necessary to address a fiscal deficit and ensure fair taxation, the farming community contends that the changes could have unintended consequences, including the erosion of family-run farms and the destabilization of rural economies.

The path forward requires dialogue, transparency, and a willingness to adapt policies in response to valid concerns. Without such efforts, the divide between policymakers and the agricultural sector is likely to deepen, with long-term implications for the UK’s food security, rural heritage, and economic stability.

The farmers’ protest in London highlights a critical moment for the UK’s agricultural sector. Faced with sweeping changes to inheritance tax, farmers have rallied to defend their livelihoods, traditions, and the future of rural communities. Their message is clear: while fiscal challenges must be addressed, the unique contributions and vulnerabilities of the farming industry cannot be overlooked.

let’s enjoy few years on earth with peace and happiness….✍🏼🙏