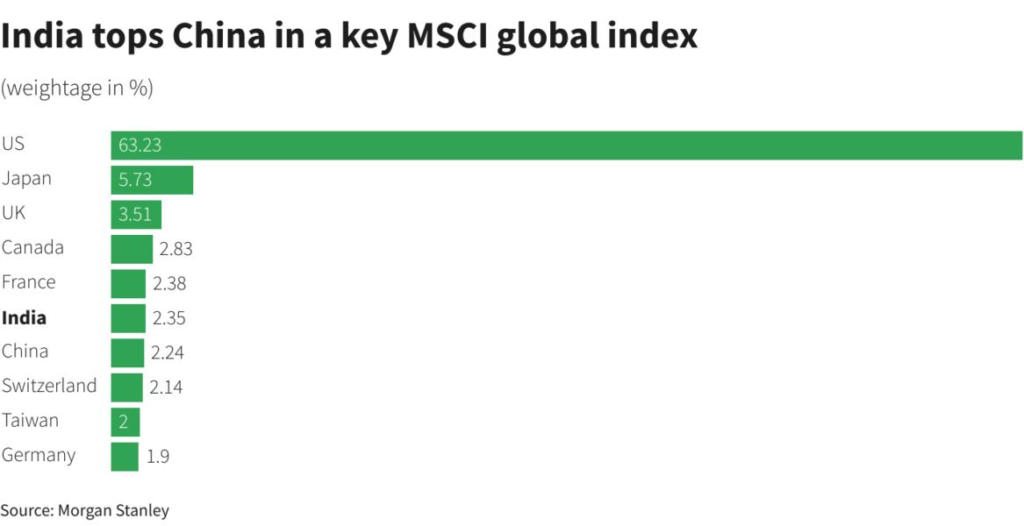

MSCI global index reflects the performance of large and mid-cap equities across various global markets. For the first time ever, India has overtaken China in this critical equity index, a development that signals India’s rising influence in global markets.

As of now, India’s weight in the MSCI investible large-, mid-, and small-cap index has surged to 2.35%, slightly above China’s 2.24%. This shift is attributed to India’s steady economic growth, robust equity market performance, and improving liquidity, positioning it as a favorable destination for investors.

India’s Economic Growth Drives MSCI Global Index Surge

India’s dominance in the MSCI global index can be traced back to its rapid economic expansion. With a nominal gross domestic product (GDP) growth rate running in the low teens, India is experiencing a significant outperformance compared to China, where economic growth has slowed.

According to analysts from Morgan Stanley, India’s nominal GDP growth rate is more than three times higher than China’s, leading to a profound divergence in earnings growth between the two nations.

The key factor driving this divergence is India’s strong internal economic momentum. Sectors like technology, consumer goods, and financial services have shown robust growth, contributing to India’s rising presence in the MSCI global index.

At the same time, China has faced challenges related to its economic slowdown and uncertainties in its property market, which have diminished investor confidence.

This shift in the MSCI global index represents more than just a temporary market fluctuation. India’s improved weightage signals a broader trend where emerging markets, particularly India, are gaining ground on global indices as they become more attractive to foreign investors. This trend is expected to continue in the coming years, with India poised to play an even more significant role in the global equity market.

Impact of India’s Rising Weight in MSCI Global Index

India’s increasing prominence in the MSCI global index will lead to substantial benefits for the country’s equity markets. The most immediate impact will be additional inflows from global investors. As India’s weightage in the index rises, institutional investors who track the MSCI global index will be compelled to increase their investments in Indian stocks. This can lead to more liquidity in the market, fostering a positive cycle of growth.

Read : The List of Top 20 Countries in Debt to China

The benchmark indexes NSE Nifty 50 and S&P BSE Sensex have already reflected this strong performance, with gains of 17% and 15%, respectively, making India one of the best-performing equity markets globally in 2024. In contrast, China’s Shanghai Composite Index has declined by approximately 9% this year due to concerns over the country’s economic outlook and its struggling property sector.

Morgan Stanley analysts have forecasted that India will continue to gain share in the MSCI global index due to market outperformance, new issuances, and liquidity improvements.

They also believe that India’s stock market rally is only past the halfway mark, implying there is more room for growth. As more global investors turn to India, this could lead to greater inflows into Indian equities, bolstering the country’s markets even further.

Additionally, India’s outperformance in the MSCI global index will also enhance its visibility on the global stage. Investors and policymakers around the world will pay closer attention to India as it cements its status as an emerging economic powerhouse. The rising weightage in the MSCI global index signals India’s transition from being a developing market to becoming a key player in the global financial landscape.

Why China’s Weight in MSCI Global Index Declined

China’s weight in the MSCI global index had peaked in early 2021, but it has since been on a decline. Several factors have contributed to this drop, starting with China’s slowing economic growth.

While China was once a driver of global economic expansion, its growth rate has decelerated sharply in recent years, driven by a combination of structural issues, regulatory challenges, and a weakening property sector.

China’s economic struggles have been further exacerbated by the fallout from its stringent zero-COVID policies, which disrupted supply chains, reduced consumer spending, and dampened economic activity. These challenges have made Chinese stocks less attractive to global investors, resulting in a decline in the country’s weightage in the MSCI global index.

The Chinese property sector has also been a major source of concern for investors. Companies in this sector have faced mounting debt issues, defaults, and slowing sales, all of which have negatively impacted China’s equity market performance. Global investors have become increasingly wary of these risks, prompting them to reduce their exposure to Chinese equities.

Furthermore, China’s government has introduced a series of regulatory crackdowns on key sectors, such as technology and education, which have hurt market confidence. As a result, investors have sought safer and more stable markets, with many turning to India as a promising alternative.

The Future of MSCI Global Index and India’s Role

Looking ahead, India’s role in the MSCI global index is expected to grow further. Analysts believe that India’s stock market will continue to outperform as the country benefits from ongoing economic reforms, a burgeoning middle class, and strong domestic demand.

The government’s focus on infrastructure development, digitalization, and attracting foreign investments will only add to this momentum.

India’s rising weight in the MSCI global index is a reflection of its broader economic transformation. The country is quickly becoming a hub for innovation, particularly in sectors like information technology, pharmaceuticals, and renewable energy.

As global investors seek opportunities in emerging markets, India’s strong fundamentals and favorable demographic trends make it an attractive destination for long-term investments.

In contrast, China’s weightage in the MSCI global index may continue to face headwinds as the country grapples with its economic slowdown and regulatory challenges. While China remains an important player in the global economy, its growth prospects are not as strong as they once were, leading to a shift in investor preferences toward markets like India.

As India overtakes China in the MSCI global index, this shift signifies a new era for global equities, where emerging markets are becoming more prominent. India’s growing influence in the MSCI global index is not just a testament to its current economic strength but also a signal of its long-term potential as a key player in the global financial system.

India’s ascent in the MSCI global index, overtaking China for the first time, reflects a broader shift in global financial markets. With its strong economic growth, robust equity market performance, and improving liquidity, India is well-positioned to continue gaining share in the MSCI global index.

As global investors recognize India’s potential, the country is poised to become an increasingly important player on the world stage, both in terms of economic influence and financial market performance.