Nvidia, the leading tech giant in graphics processing and artificial intelligence chips, recently achieved a monumental feat by surpassing Apple as the world’s most valuable company.

This change marks a significant milestone in the tech world, with Nvidia’s market value hitting $3.53 trillion, slightly edging out Apple’s valuation of $3.52 trillion, according to recent data from LSEG. Driven by soaring demand for AI chips and a relentless focus on advancing computational power, Nvidia’s rise signals a growing shift in the tech landscape.

The AI Chip Boom: Fueling Nvidia’s Record-Breaking Surge

Nvidia has been at the forefront of AI innovation, with its powerful AI chips fueling the surge in generative AI applications worldwide. The company’s chips are essential for training advanced AI models, including foundational models like OpenAI’s GPT-4, which powers ChatGPT.

Read : Everything You Need to Know About the World’s Most Valuable Company: Nvidia

The recent surge in Nvidia’s stock value came on the heels of OpenAI’s announcement of a $6.6 billion funding round to accelerate its own AI capabilities. As more companies adopt AI across various sectors, the demand for Nvidia’s GPUs has skyrocketed, making it the go-to provider for businesses investing in next-generation AI technologies.

Nvidia’s continued growth has also been supported by major advancements from other companies within the AI ecosystem. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, recently posted a 54% jump in quarterly profit due to the soaring demand for AI chips.

Read : $279 Billion Wiped Off Nvidia’s Market Value in Biggest Single-Day Loss

As AI applications expand into industries like healthcare, finance, and customer service, Nvidia is likely to remain central to the AI infrastructure, maintaining its status as a preferred supplier for foundational technologies powering AI advancements.

A Stellar Year for Nvidia: Market Performance and Investor Sentiment

Nvidia’s market performance in 2024 has been nothing short of spectacular. With a near 190% surge in stock value since the start of the year, Nvidia’s rapid climb has been fueled by investors’ high expectations and positive sentiment around AI’s transformative potential.

This year, Nvidia hit a record high, further bolstered by increased activity from option traders who have shown significant interest in the company’s stock. Its options have become some of the most traded on the market, demonstrating a confidence that Nvidia will continue to be a leader in the AI sector.

The stock has not only drawn attention from investors but also reshaped the broader U.S. stock market. Together, Nvidia, Apple, and Microsoft comprise around one-fifth of the S&P 500 index’s weightage, making their performance influential across the tech sector and beyond.

Nvidia’s momentum was also lifted by external factors, including expectations that the Federal Reserve might lower interest rates, which could benefit high-growth tech stocks like Nvidia. Additionally, an encouraging start to the earnings season has contributed to a favorable market environment, pushing the S&P 500 to an all-time high, further fueling Nvidia’s rise.

Future Outlook: Challenges and Potential Growth for Nvidia

As Nvidia gears up for its third-quarter results in November, analysts and investors are watching closely to see if it can meet or exceed its ambitious revenue forecast. The company projected third-quarter revenue of $32.5 billion, which aligns closely with analyst expectations of $32.9 billion.

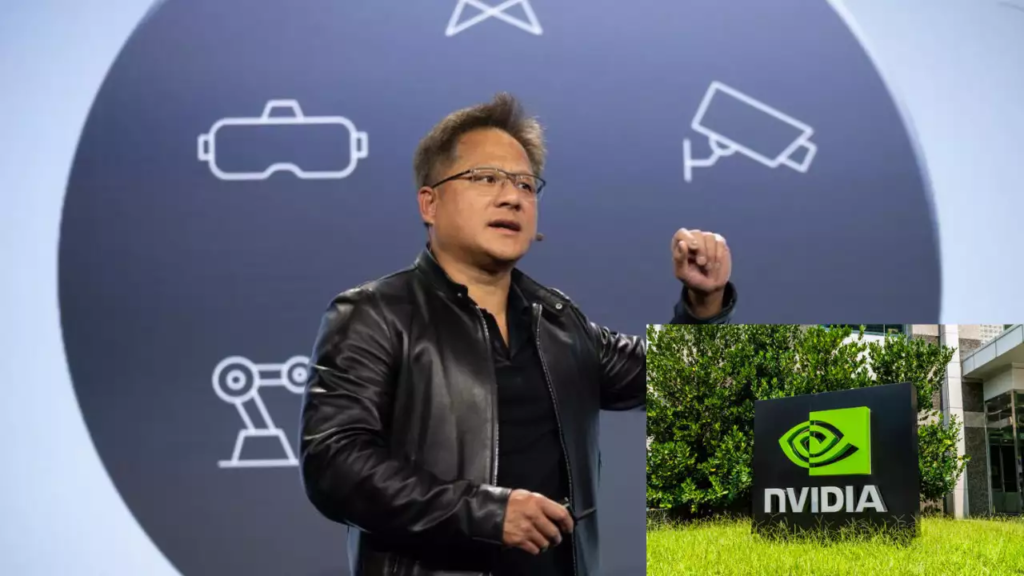

Morgan Stanley’s analyst Joseph Moore remains optimistic about Nvidia’s future, especially after meeting with CEO Jensen Huang. Moore pointed out that the company’s production of its next-generation Blackwell chips is on track and booked out for the next year, signaling strong demand from the market.

While Nvidia’s success has been remarkable, some analysts caution that investor enthusiasm around AI could lead to heightened expectations. Rick Meckler, a partner at Cherry Lane Investments, suggests that Nvidia’s revenue trajectory could be influenced by investor sentiment around AI, which may fluctuate based on new developments in the sector.

The upcoming Blackwell chip release is expected to attract significant attention, with hopes that it will push Nvidia’s technical capabilities even further. In the meantime, Nvidia’s strong positioning in the AI sector and its ability to deliver next-generation technologies will be key factors in sustaining its lead in the competitive tech landscape.