Most valuable company in the world – a title that has been fiercely contested by tech giants for years – is now within Nvidia’s grasp. With its stock soaring to unprecedented levels, Nvidia stands on the precipice of overtaking Apple to become the world’s most valuable company.

As artificial intelligence (AI) revolutionizes the global economy, Nvidia’s cutting-edge AI chips have propelled the company to the forefront of technological innovation, sparking a meteoric rise in its market value. Investors, competitors, and tech enthusiasts alike are closely watching this battle between Nvidia, Apple, and Microsoft – the titans of Silicon Valley.

Nvidia’s Meteoric Rise in the AI Race

Nvidia’s rise to the top has been nothing short of spectacular. Founded in 1993, the Santa Clara-based company originally focused on creating graphics processing units (GPUs) for gaming.

However, as AI technology began to emerge as a critical driver of the tech industry, Nvidia found itself uniquely positioned to capitalize on the trend. The company’s GPUs, known for their ability to process vast amounts of data in parallel, proved to be perfect for the demands of AI workloads.

Read : Everything You Need to Know About the World’s Most Valuable Company: Nvidia

In recent years, Nvidia has transformed from a gaming hardware company into an AI powerhouse. Its AI chips are now central to the efforts of tech giants like Alphabet, Microsoft, and Amazon as they race to build and dominate the AI space.

Read : Nvidia Loses $406 Billion in Market Value in a Week

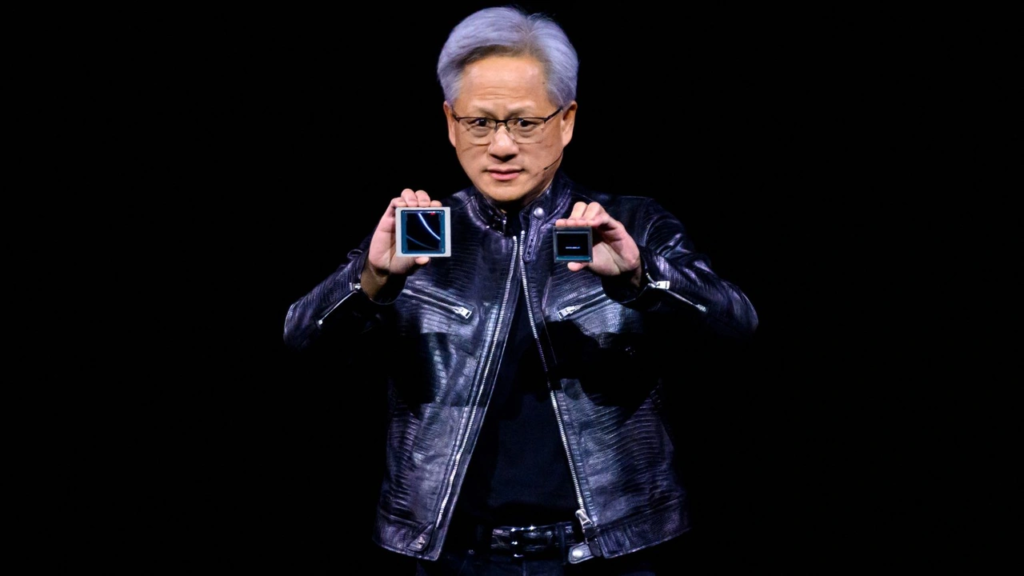

From machine learning to neural networks, Nvidia’s processors power the infrastructure that makes modern AI advancements possible. The company’s latest AI processors are already in high demand, and its upcoming generation of chips, known as Blackwell, has generated even more excitement.

While Nvidia confirmed that the production ramp-up of the Blackwell chips has been delayed until the fourth quarter of 2024, the company has downplayed the impact of the delay, noting that customers are still eager to buy its current generation of AI processors. This demand has contributed to Nvidia’s extraordinary financial performance and stock price surge.

In June, Nvidia briefly claimed the title of the world’s most valuable company, surpassing Microsoft and Apple. However, it was quickly overtaken by Microsoft. Now, as Nvidia’s stock climbs to record highs, the company is once again on the cusp of dethroning Apple. With a market value of $3.39 trillion, Nvidia is just a step behind Apple’s $3.52 trillion valuation.

AI Dominance and Financial Success

At the heart of Nvidia’s success is the rapid adoption of AI technology. As AI becomes increasingly integrated into everything from data centers to consumer products, the demand for Nvidia’s AI chips has skyrocketed.

The major players in the tech industry, including Alphabet, Microsoft, and Amazon, are all racing to build out their AI capabilities, and Nvidia is their go-to supplier for the processors that power AI systems.

Analysts have noted that the competition among these tech giants has created an investment environment where none of them can afford to fall behind.

TD Cowen, a prominent financial analyst firm, likened the situation to a “Prisoner’s Dilemma,” in which each company is incentivized to continue spending heavily on AI infrastructure because the cost of not doing so would be catastrophic. Nvidia, as the primary supplier of AI chips, is uniquely positioned to benefit from this spending spree.

According to analysts, Nvidia’s revenue is expected to more than double in 2024, reaching nearly $126 billion. This growth is being fueled by the continued expansion of AI data centers and the increasing use of AI in industries such as healthcare, finance, and autonomous vehicles.

Nvidia’s stock has surged as investors bet that the company will continue to dominate the AI space and reap the financial rewards of this technological shift.

In addition to its dominance in AI, Nvidia’s partnership with Taiwan Semiconductor Manufacturing Co. (TSMC) has played a crucial role in its success. TSMC, the world’s largest contract chipmaker, produces Nvidia’s processors and is expected to report a massive 40% jump in quarterly profits due to soaring demand for Nvidia’s chips.

This relationship between Nvidia and TSMC underscores the importance of supply chain management in the tech industry, where delays or disruptions can have significant impacts on market performance.

As Nvidia’s market value continues to rise, investors are keeping a close eye on whether the optimism surrounding AI will continue. Some worry that if spending on AI slows or if Nvidia’s competitors catch up in terms of chip performance, the company’s stock could take a hit. However, for now, Nvidia appears to be riding a wave of AI enthusiasm that shows no signs of slowing down.

The Future of Nvidia and the Tech Titans

Nvidia’s potential to dethrone Apple as the world’s most valuable company is emblematic of the shifting dynamics in the tech industry.

While Apple has long been a dominant player, thanks to its ecosystem of consumer products like the iPhone, iPad, and MacBook, Nvidia’s focus on AI and the data-driven future of technology represents a new era of growth.

As of now, Nvidia, Apple, and Microsoft collectively account for about one-fifth of the S&P 500’s total weight, giving them outsized influence over the performance of the index. When one of these companies experiences a surge or a decline, it has a ripple effect on the broader stock market.

This is a reflection of the growing importance of tech companies in the global economy, and it highlights how intertwined the fortunes of these companies are with broader market trends.

Looking ahead, Nvidia’s ability to maintain its momentum will depend on several factors. First and foremost, the company must continue to innovate in the AI space. While it currently leads the market in terms of AI chip performance, competitors like Advanced Micro Devices (AMD) and Intel are also investing heavily in AI and could pose a threat in the coming years.

Nvidia will need to ensure that its next-generation chips, including the delayed Blackwell processors, live up to the high expectations of customers and investors.

Additionally, Nvidia will need to navigate potential challenges in its supply chain. While the company’s partnership with TSMC has been a major asset, any disruptions to the global semiconductor supply chain could impact Nvidia’s ability to meet the growing demand for its chips.

This has been a concern for the entire tech industry in recent years, as supply chain disruptions caused by the COVID-19 pandemic and geopolitical tensions have highlighted the fragility of global supply networks.

Finally, Nvidia will need to maintain investor confidence in the long-term prospects of AI. While AI is currently a major driver of growth, some analysts have expressed concerns that the hype surrounding AI could eventually fade.

If companies begin to scale back their investments in AI infrastructure, Nvidia’s growth could slow. However, as of now, the AI boom shows no signs of abating, and Nvidia is well-positioned to continue benefiting from this trend.

Nvidia’s journey from a gaming hardware company to a potential contender for the title of the world’s most valuable company is a testament to the transformative power of AI.

As AI continues to reshape industries and economies, Nvidia’s AI chips have become indispensable tools for the world’s largest tech companies. With a market value just shy of Apple’s, Nvidia is on the brink of making history as the most valuable company on the planet.

However, the battle for dominance in the tech industry is far from over. Apple, Microsoft, and other tech giants are also vying for leadership in the AI space, and Nvidia will need to continue innovating to stay ahead.

As the company gears up for the release of its Blackwell chips and investors look forward to the next round of earnings reports, the stakes have never been higher for Nvidia.