Pat McGrath Labs, once a symbol of luxury beauty’s creative and commercial power, has entered Chapter 11 bankruptcy protection after nearly a decade in the cosmetics market. Founded in 2015 by legendary makeup artist Pat McGrath, the brand helped redefine modern makeup through high-impact pigments, runway-driven innovation, and a strong direct-to-consumer presence.

Court filings from January indicate that the company reported more than $50 million in liabilities, prompting a move that has surprised both industry insiders and loyal consumers. While bankruptcy filings often carry an air of finality, Chapter 11 is designed less as an ending and more as a structured pause, allowing businesses to reassess finances while continuing operations. Understanding what this filing means, and why a brand of such stature has reached this point, requires a closer look at both the legal framework and the evolving beauty industry landscape.

What Chapter 11 Bankruptcy Means for Businesses

Chapter 11 bankruptcy is a provision of U.S. bankruptcy law that allows companies to reorganize their debts while remaining operational. Unlike Chapter 7, which involves liquidation and the shutdown of a business, Chapter 11 is intended to give companies breathing room. Under this structure, the business continues to operate as a “debtor in possession,” meaning existing management usually stays in control while restructuring plans are developed under court supervision.

For companies facing cash flow constraints, mounting liabilities, or shifts in market conditions, Chapter 11 can function as a strategic reset rather than a collapse. The process allows firms to renegotiate contracts, restructure debt repayment schedules, and, in some cases, secure new financing known as debtor-in-possession loans. These loans are often granted priority repayment status, making them attractive to lenders willing to support a company’s reorganization efforts.

In the case of Pat McGrath Labs, court documents indicate the company sought approval for a $1 million emergency loan to continue paying employees and maintaining day-to-day operations. Legal filings also emphasized the founder’s intent to preserve jobs, protect the brand’s long-term value, and facilitate an orderly reorganization. This language aligns closely with the core purpose of Chapter 11, which is to stabilize operations while management and creditors negotiate a sustainable path forward.

Read : Swiss Serenity: Unveiling the Top Destinations in Switzerland

The Chapter 11 process is often lengthy and complex. Companies must submit detailed financial disclosures, propose a reorganization plan, and gain approval from both creditors and the bankruptcy court. Outcomes vary widely. Some businesses emerge leaner and more competitive, while others ultimately convert their cases to liquidation if restructuring efforts fail. Importantly, a Chapter 11 filing does not automatically erase a brand’s equity or cultural relevance, especially when the brand’s founder remains active and influential in its creative sphere.

The Rise of Pat McGrath Labs and Its Financial Challenges

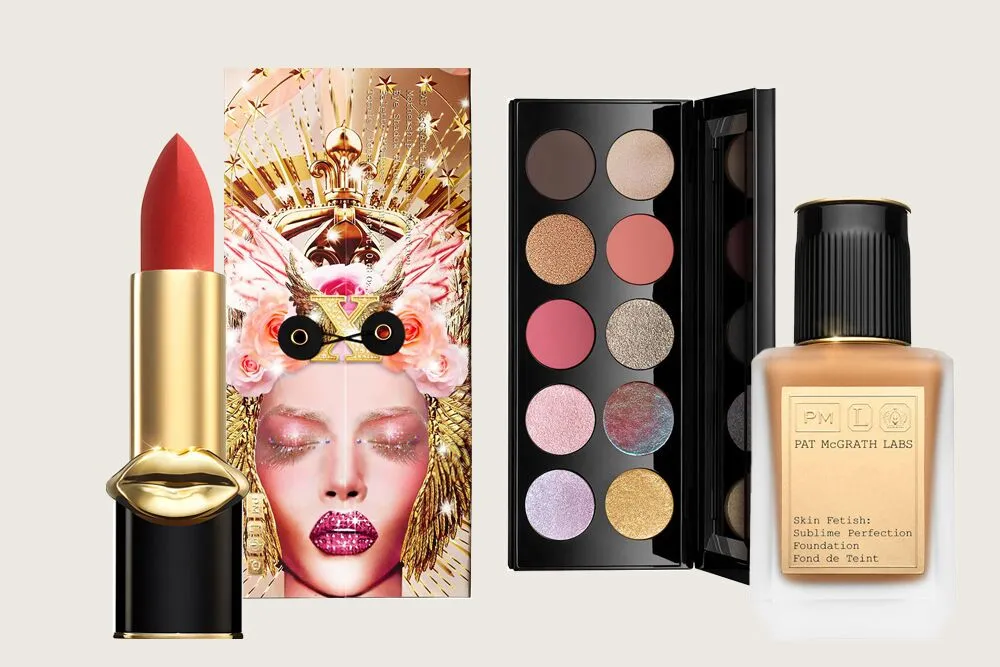

Pat McGrath Labs launched in 2015 against a backdrop of growing consumer appetite for prestige, artistry-driven makeup. Pat McGrath herself was already a towering figure in fashion and beauty, having worked with luxury houses such as Armani and Procter & Gamble, and serving as lead makeup artist for countless runway shows. The brand quickly distinguished itself through limited-edition drops, rich formulations, and an aesthetic closely tied to high fashion rather than everyday cosmetics.

The strategy paid off early. By 2018, Pat McGrath Labs was widely reported to have reached a valuation exceeding $1 billion, placing McGrath among a small group of beauty founders to achieve such status. Products like the brand’s eyeshadow palettes and complexion items became staples for professional artists and enthusiasts alike, reinforcing its reputation for performance and creativity. However, rapid growth in the beauty industry often comes with high operational costs.

Read : American Electric Truck Maker Company Nikola Files for Chapter 11 Bankruptcy

Luxury packaging, premium ingredients, global distribution, and marketing tied to fashion weeks and runway shows require significant capital. As the market matured, competition intensified. Celebrity-backed brands, often supported by massive social media reach and simplified product offerings, began to dominate shelf space and consumer attention. These brands frequently emphasize relatability, speed-to-market, and lower price points, creating pressure on heritage and artistry-focused labels.

Retail dynamics have also shifted. Traditional wholesale partnerships with major beauty retailers have become less predictable, while direct-to-consumer sales require ongoing investment in digital infrastructure, logistics, and customer acquisition. Economic uncertainty, inflationary pressures, and changing consumer spending habits have further complicated the picture. Many consumers have become more selective, favoring multifunctional products or brands with strong personal narratives tied to celebrities rather than professional artistry.

Against this backdrop, Pat McGrath Labs reportedly planned to auction off brand assets, a move that signaled deeper financial strain. That auction has since been indefinitely postponed following the Chapter 11 filing, suggesting that restructuring may offer an alternative path to resolving creditor claims. The reported $50 million-plus in liabilities underscores the scale of the challenge, even for a brand once considered a benchmark of modern luxury beauty.

What the Bankruptcy Filing Signals for the Beauty Industry and the Brand’s Future

The Chapter 11 filing by Pat McGrath Labs is not only a story about one company’s finances but also a reflection of broader changes within the beauty industry. Over the past decade, the market has become crowded with new entrants, many of them celebrity-founded or influencer-driven. These brands often launch with built-in audiences and lower overheads, relying heavily on social media marketing rather than traditional fashion and editorial ecosystems.

Read : Snowboarder Ryan Wedding Who Was on FBI’s Ten Most Wanted Fugitives List Arrested in Mexico

For legacy-inspired brands rooted in professional artistry, maintaining relevance requires balancing creative integrity with commercial efficiency. Pat McGrath Labs has remained closely tied to the founder’s work on major runways, including the 2025 Victoria’s Secret Fashion Show and high-profile couture presentations such as Schiaparelli during Paris Haute Couture Fashion Week. These appearances reinforce McGrath’s personal prestige but do not always translate directly into mass-market sales growth.

Despite the bankruptcy filing, Pat McGrath’s influence within fashion and beauty remains largely intact. Her recent work continues to generate viral moments, such as the glossy, doll-like makeup look from the 2024 Margiela runway, which inspired product launches under the brand’s “Skin Fetish: Glass 001” line. This ongoing cultural relevance suggests that the creative engine behind the brand is still strong, even if the business structure requires recalibration.

Chapter 11 offers the possibility of streamlining operations, renegotiating supplier agreements, and reassessing product portfolios. For Pat McGrath Labs, this could mean focusing on core hero products, adjusting distribution strategies, or seeking new investment partners aligned with a long-term vision rather than rapid expansion. The postponement of the asset auction indicates that stakeholders may see more value in reorganization than in dismantling the brand.

More broadly, the filing highlights the vulnerability of even the most celebrated names in beauty to shifting consumer behavior and economic realities. Prestige alone is no longer a guarantee of financial stability. Brands must continuously adapt to changes in how consumers discover, purchase, and engage with products. For the industry, Pat McGrath Labs’ situation serves as a reminder that innovation must extend beyond formulation and aesthetics to include sustainable business models.

Whether Pat McGrath Labs ultimately emerges from Chapter 11 as a restructured entity or undergoes more significant transformation remains to be seen. What is clear is that Chapter 11 does not mark an immediate end. Instead, it represents a critical juncture, one that could redefine how an iconic beauty brand operates in an increasingly competitive and celebrity-driven market.