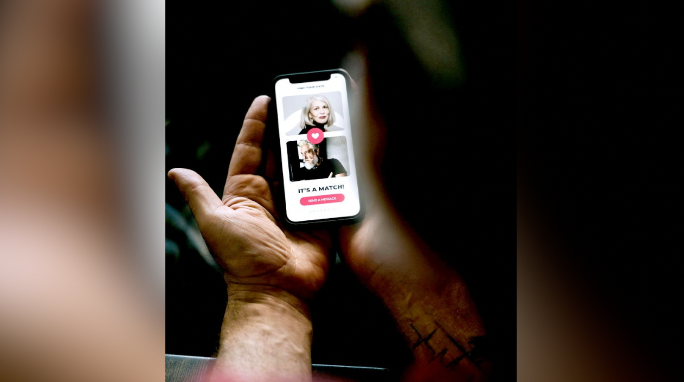

In an era where digital connections promise both excitement and peril, a heartbreaking tale of deception has emerged from the heart of Colorado. A man, whose identity remains shielded to spare him further public scrutiny, has come forward with a stark warning after losing his entire life savings—$1.4 million—to a cunning cryptocurrency romance scam. What began as a discreet search for companionship on Ashley Madison, a platform notorious for facilitating extramarital affairs, spiraled into a financial catastrophe that has left him reeling.

This incident, reported across multiple outlets in late September 2025, underscores the insidious blend of emotional manipulation and technological exploitation that defines modern scams. As authorities investigate, the victim’s story serves as a chilling reminder of how vulnerability can be weaponized in the shadows of the internet. The man’s ordeal highlights a disturbing uptick in “pig butchering” schemes, where scammers fatten up their targets with affection before slaughtering their finances through fake investments.

According to the Federal Trade Commission, romance scams alone racked up over $1.14 billion in losses in 2023, with cryptocurrency adding an irreversible layer of difficulty for recovery. In Colorado, where the tech-savvy population increasingly dabbles in digital assets, such frauds are hitting closer to home. The Colorado Bureau of Investigation has flagged this case as one of the largest single losses they’ve encountered, prompting a broader alert to the public.

The Spark of Deception: A Troubled Marriage Leads to Ashley Madison

The seeds of this scam were sown in the quiet dissatisfaction of a long-term marriage. The victim, a resident of Lakewood in the Denver metro area, had been wed for two decades but found himself adrift in a sea of marital discord. “I was unhappy,” he later confided to reporters from 9News and KDVR, his voice heavy with regret. Seeking an escape, he turned to Ashley Madison, the infamous dating site marketed explicitly to married individuals craving discreet encounters. Launched in 2002, the platform boasts millions of users worldwide, promising anonymity and excitement but often delivering heartbreak—or worse.

It was there, amid profiles cloaked in secrecy, that he first connected with “Erin.” Her messages arrived like a lifeline: warm, engaging, and laced with shared vulnerabilities. She portrayed herself as a successful businesswoman with stakes in a family winery, real estate holdings, and a savvy hand in cryptocurrency trading. Their chats quickly evolved from flirtatious banter to intimate confessions, moving seamlessly from the site’s interface to WhatsApp for more private exchanges. “She sent pictures, live videos of herself and her place where she was living. We chatted live,” the man recounted to CBS News, emphasizing the authenticity that blurred the line between fantasy and reality.

What he didn’t know was that Erin was likely a fabricated persona, a common tactic in romance scams. Investigators from the Colorado Bureau of Investigation suspect she was part of an overseas operation, possibly in Southeast Asia, where such syndicates thrive. These groups employ professional scripts, stolen photos, and even coerced individuals for video calls to build trust rapidly. Within days, the conversation shifted from romance to rescue. As the man hinted at an impending divorce, Erin positioned herself as a financial ally.

Read : 23-Year-Old Blake Kieckhafer Missing in Colorado’s Rocky Mountain National Park

“Oh, by the way, I’m into Bitcoin, crypto stuff, and make lots of money,” she allegedly told him. “I can help you try to save your money if you go through a divorce.” It was a pivot so seamless, so attuned to his fears, that he never saw the hook sinking deeper. This phase of the scam exemplifies the emotional groundwork laid by fraudsters. Experts note that scammers target platforms like Ashley Madison precisely because users there are already in a state of emotional flux—lonely, perhaps guilt-ridden, and desperate for validation.

Read : Health Officials in US Confirm First Human Case of Plague in Colorado

The man’s decision to engage wasn’t born of recklessness but of a profound human need for connection. Yet, in the digital realm, that need becomes a vulnerability. As their bond intensified over weeks, Erin’s tales of crypto windfalls painted a picture of easy wealth: quick trades yielding massive returns, a digital gold rush just a transaction away. He began to envision not just emotional solace but financial security, a buffer against the ruins of his marriage. Little did he know, this was the calm before the financial storm.

The Financial Plunge: From Flirtation to Four Fatal Transactions

Emboldened by Erin’s guidance, the man took his first tentative steps into the world of cryptocurrency—a domain he admits was entirely foreign to him. “From the time we were introduced, it was probably within a week that I transferred the first of four transactions,” he told 9News, his tone a mix of disbelief and self-reproach. What followed was a rapid escalation: over the course of approximately six weeks, he liquidated portions of his retirement and life savings, funneling $1.4 million into what he believed was a prosperous investment vehicle.

The process started innocently enough. Erin directed him to legitimate cryptocurrency apps, where he made initial transfers that appeared to yield small gains—fabricated returns designed to hook him further. “I’ve never guessed I’d be duped like this,” he later reflected, acknowledging the thrill of those early “wins.” But soon, the instructions veered into treacherous waters. He was urged to download a bogus app, controlled entirely by the scammers, where the funds vanished into a black hole of irreversible blockchain transactions. Each of the four transfers grew larger, fueled by Erin’s assurances of exponential growth. She dangled visions of a shared future: vacations funded by crypto hauls, a life unburdened by his marital woes.

Colorado Bureau of Investigation Special Agent Zeb Smeester, who is spearheading the probe, described the sum as staggering. “This is the most money I’ve ever seen lost in an online scam like this one,” Smeester told reporters. The agent’s astonishment underscores the scale: $1.4 million isn’t pocket change; it’s a lifetime of disciplined saving, now evaporated in a haze of pixels and promises. The scam’s mechanics relied on the anonymity of crypto—transactions that can’t be clawed back like a wire transfer or credit card charge. Once sent, the funds dispersed across wallets in jurisdictions beyond easy reach, a hallmark of these international operations.

In hindsight, red flags abound: the reluctance to meet in person, the pressure to act swiftly, the guarantees of outsized returns. Yet, in the grip of infatuation, they faded into the background. The man, now “in pretty deep” as he put it to KDVR, watched his nest egg dwindle not in one fell swoop but in calculated increments, each one rationalized by Erin’s soothing words. By the time doubt crept in—perhaps after the final transfer, when the app’s interface began to glitch—he was too entangled to pull back. The emotional investment matched the financial one; admitting defeat meant confronting not just loss of money, but loss of the illusion of love. This layered deception is what makes crypto romance scams so devastating: they don’t just steal wealth; they shatter trust in one’s own judgment.

As the dust settled, the victim reached out to authorities, filing reports that have mobilized the CBI and even drawn federal attention. Recovery efforts are underway, but Smeester cautions that overseas perpetrators make it a long shot. “Trust is definitely the name of the game,” he explained. “With a romance scam, the trust is kind of built into the relationship.” For this Colorado man, that trust cost him everything he had built for retirement, leaving him to rebuild from emotional and financial bedrock.

Lessons from the Loss: Safeguarding Hearts and Wallets in the Digital Age

The aftermath of this scam has transformed the victim from a private individual into an unwitting advocate, his story a clarion call against the perils of online entanglements. “If it’s too good to be true, it’s not true,” he advised in interviews, distilling a lifetime’s wisdom into a hard-won axiom. “You were taken advantage of,” CBI agents reassured him, a validation that offered scant comfort amid the ruins. Now, as the investigation unfolds, his experience illuminates broader patterns and prevention strategies for a public increasingly ensnared by similar traps.

At its core, this incident reflects the explosive rise of hybrid scams merging romance with investment fraud. The Better Business Bureau’s 2024 Scam Tracker ranks investment schemes, especially those involving cryptocurrency, as the riskiest, with romance cons a close third—and often intertwined. Director of Foundation Meghan Conradt notes, “Unfortunately, this is something we at the BBB see a lot of.” In 2023 alone, over 64,000 romance scam reports flooded the FTC, translating to $1.14 billion in losses. Crypto’s allure—its promise of borderless, high-yield gains—makes it the perfect bait, but its irreversibility turns it into a predator’s paradise.

Authorities urge vigilance: Verify identities through reverse image searches or mutual contacts; never send money to online suitors, no matter the sob story; and consult trusted advisors before dipping into savings. The CBI emphasizes reporting to local police and the FBI’s Internet Crime Complaint Center at ic3.gov, where aggregated data can dismantle networks. For those on dating sites like Ashley Madison, extra caution is paramount—scammers prowl these waters, exploiting the platform’s veil of secrecy.

Yet, beyond tactics, this tale probes deeper human frailties: loneliness in a connected world, the siren call of quick fixes for aching hearts. The victim, grappling with divorce’s shadow, found in Erin a mirror to his desires, only to shatter against reality. His loss, while immense, isn’t irredeemable; he’s vowed to educate others, turning pain into purpose. As Agent Smeester observes, even the financially astute fall prey—greed and isolation are universal chinks in the armor.

In Colorado’s vibrant yet vulnerable communities, stories like this ripple outward, prompting soul-searching about our digital dalliances. The man’s $1.4 million vanishing act isn’t just a statistic; it’s a wake-up call to cherish real connections over virtual mirages, to guard our affections as fiercely as our assets. In an age where love letters arrive via algorithm and fortunes flip on a blockchain, perhaps the greatest safeguard is skepticism wrapped in self-compassion. For now, as probes continue, one Colorado man’s heartbreak stands as a beacon: Proceed with eyes wide open, hearts a little wiser.