In a dazzling intersection of tradition and technology, Shanghai has now become home to the world’s first fully-automated “Gold ATM,” a pioneering innovation that is already making waves.

As the global prices of gold continue to soar, people in China are turning to this high-tech marvel to monetize their generational gold holdings with unprecedented speed and convenience.

While this breakthrough is shaping the gold market dynamics in real-time, its ripple effects are already stirring conversations beyond China’s borders—especially in India, a nation that holds a deep cultural and economic connection with the precious metal.

At the heart of this technological evolution lies not just innovation, but also the psychology of gold ownership in uncertain economic times. With inflation pressures, volatile markets, and growing concerns over financial stability, gold has regained its age-old status as a reliable store of value.

The gold ATM in Shanghai is not just a machine—it is a mirror to shifting consumer behaviors, an enabler of liquidity, and perhaps, a hint at what the future of gold trading might look like.

A Futuristic Turn for an Ancient Asset

Gold has been central to human economies and cultures for millennia. In China, as in India and several other parts of Asia, gold is more than just a commodity—it’s a cultural symbol, often gifted during weddings, festivals, and important family events. It is considered auspicious, a protector of wealth, and a form of intergenerational savings.

Traditionally, people have held onto gold for decades, passing it from one generation to the next. But now, all of that is being reimagined in the face of skyrocketing gold prices and modern financial innovations.

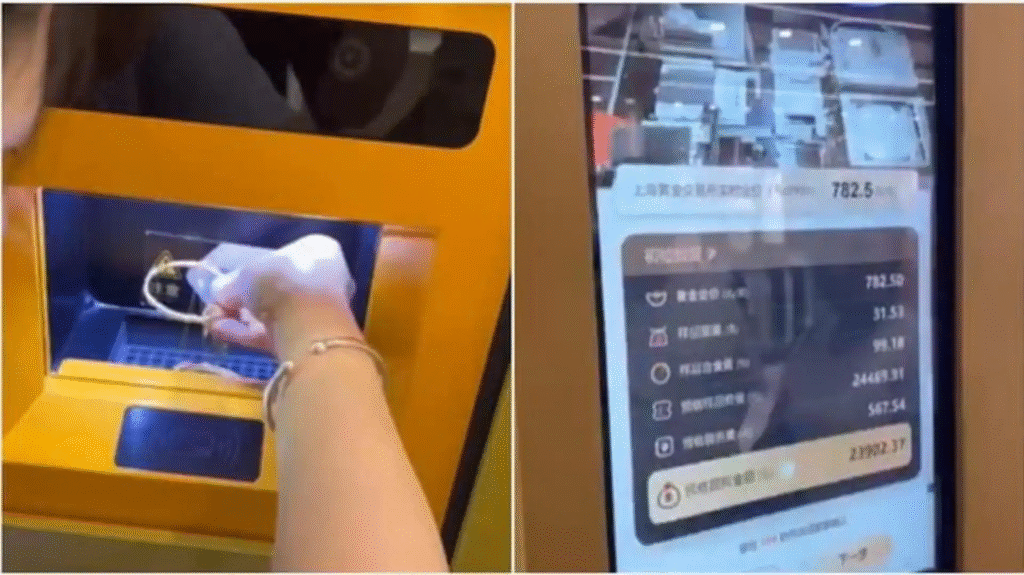

The newly installed gold ATM in Shanghai has redefined how individuals can transact with gold. Installed in a bustling mall, the machine allows users to insert their gold jewellery, which is then automatically weighed, assessed for purity, and valued based on current market prices. The entire process is automated, eliminating human interaction and making transactions quicker and more transparent.

Operated by China’s Kinghood Group, the ATM promises not only speed and efficiency but also competitive pricing. The machine offers buyback prices of around $98 per gram, while retail prices for AU999 (pure gold) jewellery hover around $116 per gram.

A gold ATM in Shanghai, China

— Tansu Yegen (@TansuYegen) April 19, 2025

It melts the gold and transfers the amount corresponding to its weight to your bank account.

pic.twitter.com/hFu3AjqEo2

These rates are said to be slightly lower than other branded retailers due to Kinghood’s control over mining sources. And that seems to be drawing in the crowds. Long queues have been observed at the site, with individuals eager to trade in their old and sometimes emotionally significant gold pieces.

For many, the opportunity to cash in gold purchased years or decades ago at much lower prices is simply too good to pass up. With the touch of a screen and a short wait, people are walking away with cash in hand—something that would have taken hours or even days in the traditional gold selling process.

Gold, Emotions, and Economics

The gold ATM, while technologically impressive, also raises questions about the shifting emotional landscape around gold ownership. Traditionally, gold jewellery in China, as in India, is tied to family legacy. It’s not just an asset; it’s a token of family heritage, passed down with love and pride. The rush to sell these items now signals a deeper economic need, or perhaps, a changing mindset where practicality is beginning to overshadow sentimentality.

With global gold prices climbing steadily due to sustained demand from central banks and institutional investors, many individuals are seeing this as a rare window of opportunity. The potential to sell at a high profit margin is simply too compelling for many to ignore, especially for those who are facing financial uncertainties.

According to Xu Weixin, a member of the Shanghai Gold Association, this surge in gold vending is primarily driven by the recycling functionality that these ATMs offer.

He notes that the real value of gold holdings has seen a significant boost in recent months, prompting people to monetize their gold quickly. However, Xu also cautions against acting on impulse, advising that the gold market still has upward potential and that holding onto gold could be more beneficial in the long term.

This juxtaposition—of the practical versus the emotional, the traditional versus the modern—is playing out in full view in Shanghai. People are grappling with decisions that are deeply personal yet economically motivated. And as this technology gains visibility, many are wondering if India—arguably the world’s biggest consumer of gold—might follow suit.

Could India Be Next?

India has always had an intimate relationship with gold. It is the largest importer and consumer of gold globally, and its citizens hold an estimated 25,000 to 27,000 tonnes of the precious metal in private hands.

From a social and cultural standpoint, gold in India is synonymous with status, security, and spirituality. But it’s also increasingly being viewed through the lens of investment.

The question now is: could gold ATMs work in India? On the surface, the concept seems perfectly suited to the Indian market. Long queues outside gold loan providers and jewellery shops are common during times of economic hardship or when prices spike. Introducing an automated, user-friendly machine that can offer quick cash in exchange for gold could revolutionize this process—just like it is beginning to in Shanghai.

Yet, India poses its own unique set of challenges. For one, the emotional attachment to gold runs even deeper here. People might be more hesitant to trust a machine with heirloom jewellery or wedding ornaments.

Additionally, the Indian market is highly fragmented, with a large number of small and unregulated gold vendors who might see such technology as a threat to their business model.

There’s also the issue of trust and verification. While the gold ATM in Shanghai seems to have robust systems for quality checking and price validation, Indian consumers might still prefer the human assurance of a jeweller’s expertise, especially when large sums of money are involved.

That said, the Indian fintech space is rapidly evolving. If companies can create a culturally sensitive model that blends technology with traditional customer service—perhaps with options to review assessments before selling or including an in-person support kiosk—the potential is enormous. Given the sheer scale of gold ownership in India, even a small adoption rate could translate into significant market activity.

Moreover, gold recycling in India is already a growing sector. With the government’s push toward formalizing gold trade and encouraging gold monetization schemes, the introduction of gold ATMs could serve as a logical extension of these efforts. They could also help in boosting transparency and curbing the informal economy that thrives around gold transactions.

Shanghai’s launch of the world’s first gold ATM is more than just a technological milestone—it’s a cultural moment that signals a shift in how people perceive and interact with one of the oldest forms of wealth.

As people line up to sell off family jewellery that may have been sitting idle in lockers for decades, the ATM stands as a symbol of modern efficiency meeting age-old tradition.

While not without its challenges, this innovation opens up new conversations about the future of gold commerce. And if the response in China is any indicator, countries like India might not be far behind in adapting similar models. The need for liquidity, the lure of high prices, and the convenience of technology may just outweigh tradition and sentiment—at least for some.

Whether this trend will become a new normal or remain a localized curiosity remains to be seen. But one thing is clear: gold, in all its glittering glory, continues to evolve with us.